Estimated Growth Potential Of The Life And Non-Life Insurance Market 2023-2032- Includes Life And Non-Life Insurance Market Size

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

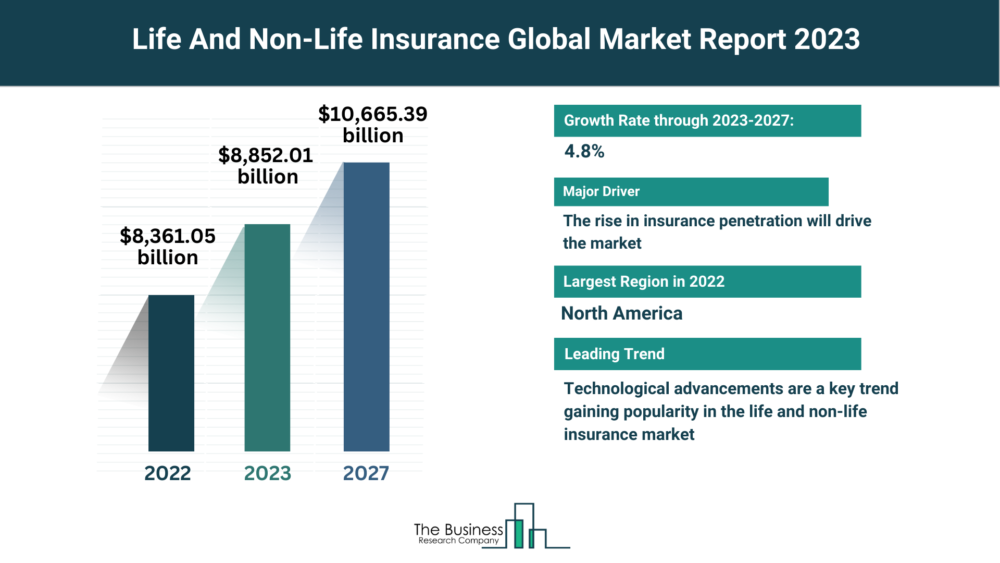

The global life and non-life insurance market is poised for substantial growth, marked by increasing market size and a surge in insurance penetration. Let’s delve into the driving factors and emerging trends shaping the landscape of this dynamic industry.

- Insurance Penetration: A Catalyst for Growth

- Defining Insurance Penetration:The rise in insurance penetration, indicating the level of insurance coverage in relation to the total insurable market or population, is a key driver of market growth.

- Advantages of Higher Penetration:Increased insurance penetration offers advantages such as enhanced financial protection, risk mitigation, and overall market stability. These benefits extend to individuals, businesses, and the broader economy.

Examples: In 2021, the US saw an 11.5% increase in life insurance premiums, demonstrating the impact of rising insurance penetration. Similarly, Sweden’s insurance penetration rose from 9.8% in 2020 to 11.2% in 2021, according to the Organization for Economic Co-operation and Development.

- Major Players Shaping the Market

- Key Market Players:The life and non-life insurance market is influenced by major players like Ping An Insurance, China Life Insurance Company, Allianz SE, Axa SA, Prudential plc, and others.

- Global Influence:These companies play a pivotal role in providing insurance solutions on a global scale, contributing to market dynamics and customer choices.

- Technological Advancements: A Transformative Trend

- Emerging Trend:Technological advancements are reshaping the life and non-life insurance landscape, with companies focusing on innovative solutions to strengthen their market position.

- Sure Insurance LLC’s Retrace:* In March 2023, Sure Insurance LLC launched Retrace, an e-commerce solution that offers inbuilt one-click insurance and protection for online retailers. This technology simplifies the online purchasing process, making it less frustrating for both consumers and retailers.

Benefits: Retrace includes a collection of APIs that enable online retailers to integrate security and insurance seamlessly, enhancing the overall online shopping experience.

- Market Segmentation: Understanding Diversity

- Insurance Type Segmentation:The market is segmented into Life Insurance and Non-Life Insurance, reflecting the diverse coverage areas within the insurance industry.

- Coverage Type Segmentation:Lifetime Coverage and Term Coverage represent the different durations and structures of insurance offerings.

- Distribution Channels:The distribution channels include Direct Sales, Brokers and Individual Agents, Bankers, and Other Channels, reflecting the varied ways insurance products reach consumers.

- End Users Segmentation:The market caters to different end users, including Corporates, Individuals, and Other End Users, showcasing the broad spectrum of consumers in the insurance market.

- Regional Dynamics: North America Leading, Asia-Pacific Accelerating

- North America’s Dominance:In 2022, North America held the largest share in the global life and non-life insurance market, emphasizing its established position.

- Asia-Pacific’s Growth:* The forecast predicts Asia-Pacific as the fastest-growing region in the coming years. This growth is fueled by increasing economic activities, rising awareness, and the expanding middle class.

View More On The Life And Non-Life Insurance Market Report 2023 – https://www.thebusinessresearchcompany.com/report/life-and-non-life-insurance-global-market-report

Request A Sample Of The Global Life And Non-Life Insurance Market Report 2023:

https://www.thebusinessresearchcompany.com/sample_request?id=10812&type=smp

The Life And Non-Life Insurance Global Market Report 2023 provides comprehensive insights on the life and non-life insurance market size, trends and drivers, opportunities, strategies, and competitor analysis. The countries covered in the life and non-life insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

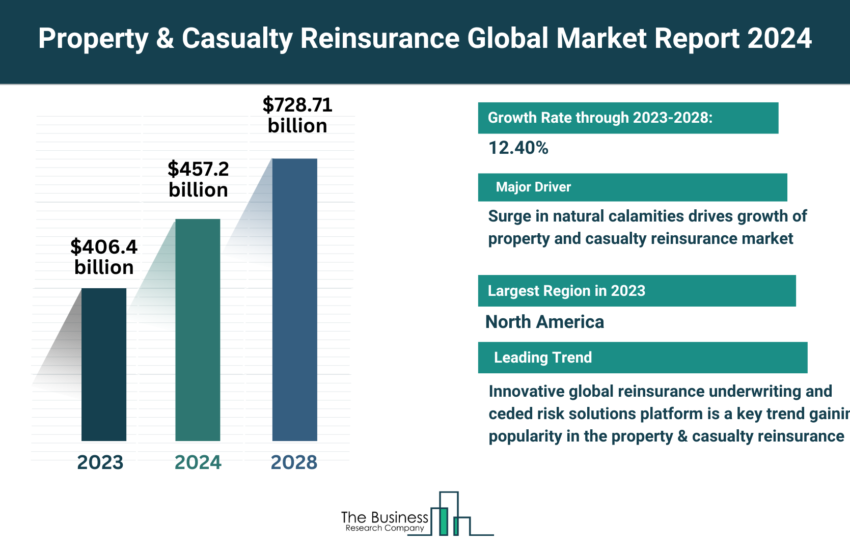

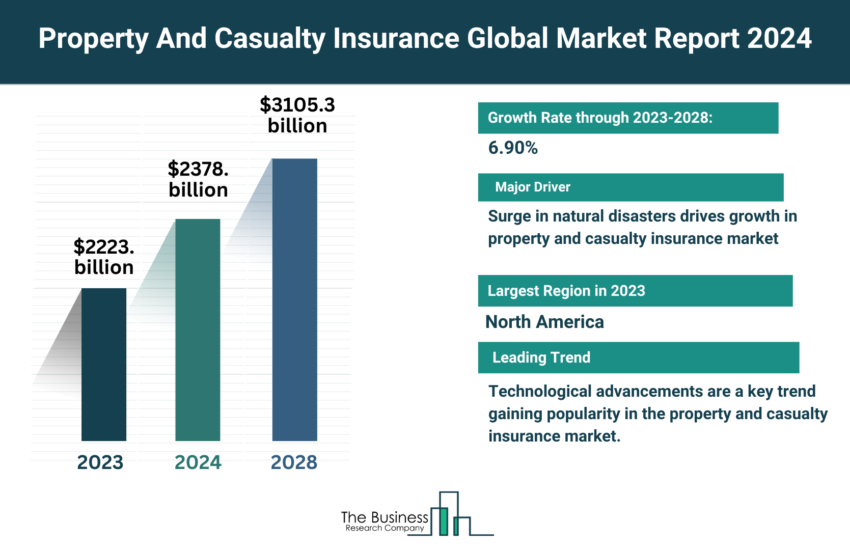

Insurance, Reinsurance And Insurance Brokerage Global Market Report 2023

Reinsurance Global Market Report 2023

Insurance Analytics Global Market Report 2023

Learn More About The Business Research Company

The Business Research Company has published over 3000+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model