Global Property & Casualty Reinsurance Market Report 2024: Size, Drivers, And Top Segments

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

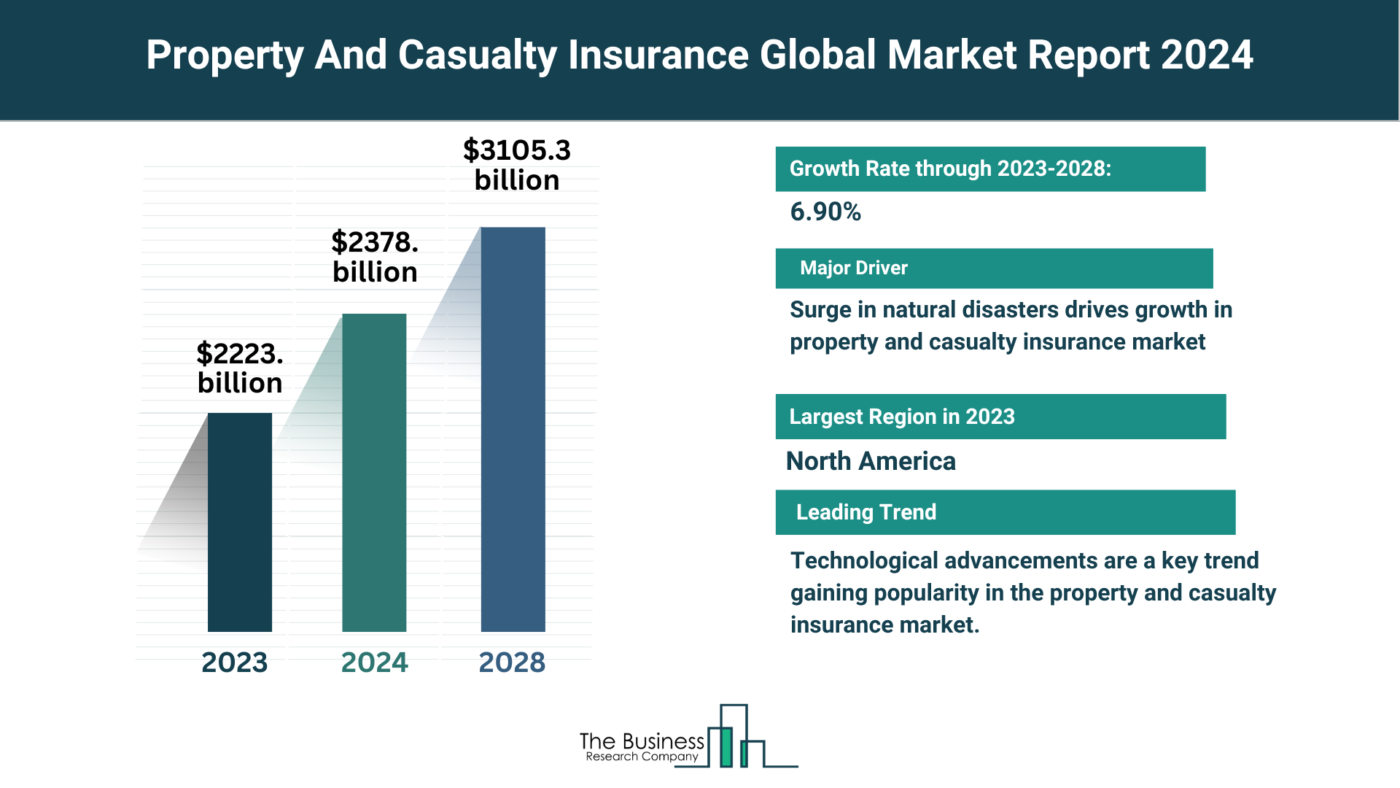

The property & casualty reinsurance market size has seen significant expansion in recent years, with a compound annual growth rate (CAGR) of 12.5% from 2023 to 2024, reaching $457.22 billion. This surge can be attributed to various factors:

- Economic growth and asset accumulation

- Regulatory requirements and compliance

- Globalization and increased business risks

- Natural disasters and catastrophic events

- Legal liability concerns

The Prophesied Growth

Looking ahead, the market is poised for continued acceleration, projected to hit $728.71 billion by 2028, with a CAGR of 12.4%. Anticipated catalysts for this forecasted growth include:

- Climate change and extreme weather events

- Cybersecurity risks and data breaches

- Global economic trends and trade risks

- Liability concerns in the digital age

- Pandemic and public health risks

View More On The Property & Casualty Reinsurance Market Report 2024 – https://www.thebusinessresearchcompany.com/report/property-and-casualty-reinsurance-global-market-report

Major Trends Shaping the Future

In addition to the overarching growth, several trends are expected to redefine the landscape:

- Customer-centric solutions

- Integration of IoT devices

- Rise of parametric insurance

- Collaboration with ecosystem partners

- Pandemic preparedness

Surge In Natural Calamities Drives Growth Of Property And Casualty Reinsurance Market

Embracing the Challenge

The increase in natural calamities serves as a catalyst for the property and casualty reinsurance market. Natural disasters, ranging from earthquakes to hurricanes, inflict substantial damage, prompting the need for risk mitigation strategies. For example:

- In 2022, the US witnessed 18 climate disasters, costing $175.2 billion in damage and claiming 474 lives.

- Reinsurance offers a vital mechanism for insurers to manage concentrated disaster risks.

Innovative Global Reinsurance Underwriting And Ceded Risk Solutions Platform

Pioneering Innovation

Product innovation emerges as a driving force in the market, with companies prioritizing the development of novel solutions. Notable instances include:

- Ascot Group’s launch of a global reinsurance underwriting and ceded risk solutions platform, enhancing client services and claims management.

- Swiss Reinsurance Company Ltd.’s acquisition of Champlain Reinsurance Company, bolstering expertise in legacy solutions.

Segmentation Insights

Understanding the Dynamics

The property & casualty reinsurance market is segmented based on various parameters:

- Type: Direct Selling, Intermediary Selling

- Mode: Online, Offline

- Application: Small Reinsurers, Midsized Reinsurers

- End-User: Life And Health Reinsurance, Non-Life Or Property And Casualty Reinsurance

Regional Dominance

North America Takes the Lead

North America emerged as the largest region in the property and casualty reinsurance market in 2023, showcasing the region’s prominence in driving market dynamics.

In conclusion, the property & casualty reinsurance market stands at the cusp of unprecedented growth, fueled by a confluence of factors and propelled by innovative strategies and solutions. As the global landscape evolves, the resilience and adaptability of the market will remain paramount in navigating the challenges and opportunities that lie ahead.

Request A Sample Of The Global Property & Casualty Reinsurance Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=9644&type=smp

The Property & Casualty Reinsurance Global Market Report 2024 provides comprehensive insights on the property & casualty reinsurance market size, trends and drivers, opportunities, strategies, and competitor analysis. The countries covered in the property & casualty reinsurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Insurance Brokers & Agents Global Market Report 2024

Insurance, Reinsurance And Insurance Brokerage Global Market Report 2024

Insurance Analytics Global Market Report 2024

Learn More About The Business Research Company

The Business Research Company has published over 3000+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model