Insights Into The B2B Payments Market’s Growth Potential 2023-2032

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

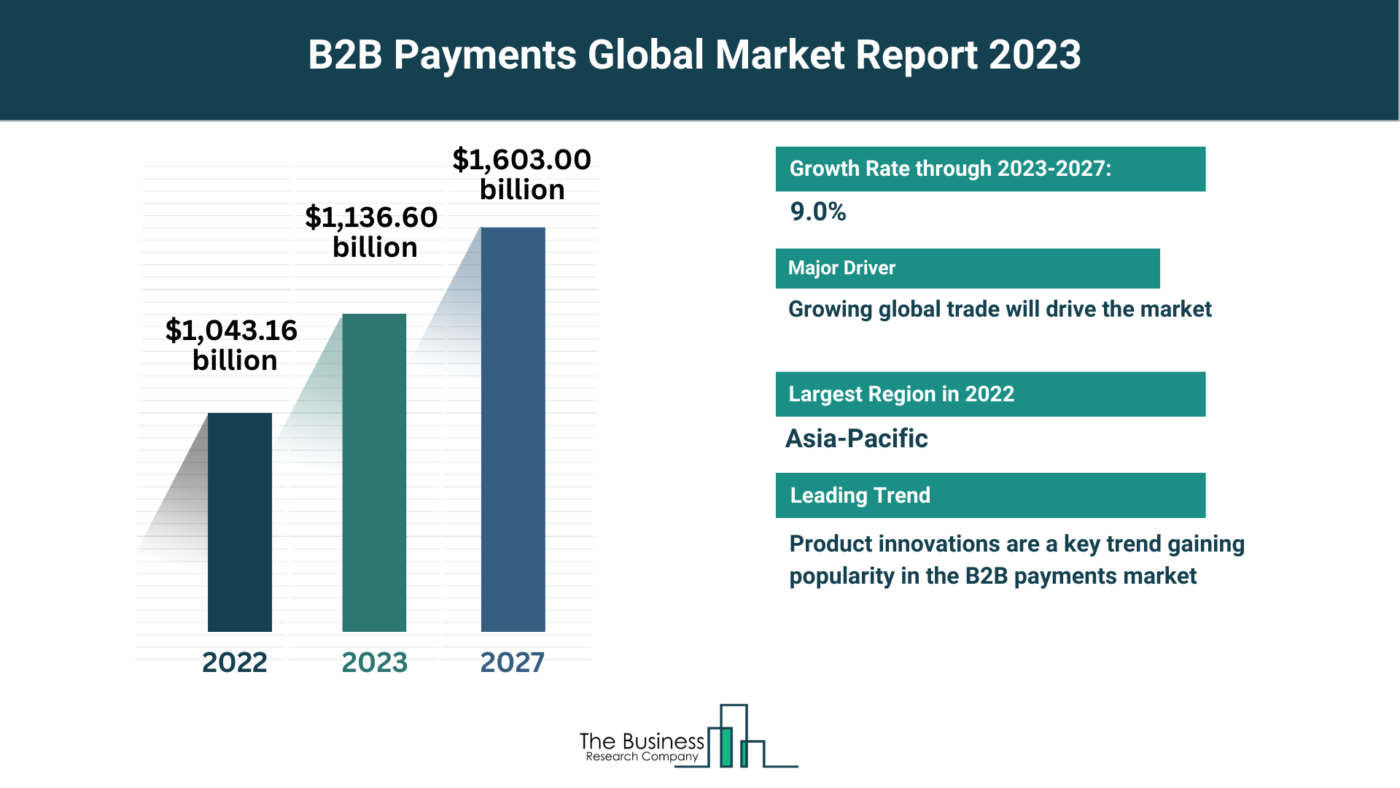

The global B2B payments market is experiencing substantial growth, with a projected increase from $1,043.16 billion in 2022 to $1,136.60 billion in 2023 at a compound annual growth rate (CAGR) of 9.0%. Looking ahead, the market is poised to reach $1,603.00 billion in 2027, maintaining a steady CAGR of 9.0%. Let’s delve into the driving forces behind this growth and the key players shaping the landscape.

Fueling Growth: Global Trade Dynamics

Global Trade’s Impact The B2B payments market is set to thrive on the back of growing global trade activities. International transactions for goods and services are the bedrock of B2B payments, facilitating the swift exchange of currency in import and export deals.

Trade Statistics According to the United Nations Conference on Trade and Development, global trade witnessed a remarkable 25% increase, reaching $28.5 trillion in 2021 compared to the previous year. Furthermore, the World Trade Organization reports a 3.5% surge in global merchandise trade volumes in 2022. These statistics underscore the pivotal role of B2B payments in the burgeoning landscape of global trade.

Major Players Shaping the B2B Payments Arena

Industry Titans Key players driving the B2B payments market include American Express Company, Bank of America Corporation, Mastercard Inc., PayPal Holdings Inc., and JPMorgan Chase & Co, among others.

Innovation at the Core A notable trend within the market is the emphasis on product innovations by major companies. These players are investing in advanced technological solutions to fortify their positions in the competitive landscape.

Exemplary Innovation In December 2022, American Express introduced Amex Business Link, a digital B2B payment ecosystem designed for network issuing and acquiring participants. This innovative platform is tailored to seamlessly integrate with customer relationship management (CRM) and enterprise resource planning (ERP) systems accepting APIs. Offering support for both domestic and international transactions, Amex Business Link accepts card and non-card payments, ensuring convenience for entities of all sizes. Noteworthy features include dynamic data for automatic reconciliation and insights into sales and purchases.

Segmentation: Navigating the B2B Payments Landscape

1) By Payment Type: Domestic and Cross-Border Payments The B2B payments market is categorized based on payment types, distinguishing between domestic and cross-border payments.

2) By Payment Mode: Bank Transfer, Cards, and Other Payment Modes Different payment modes, including bank transfers, cards, and various other methods, offer diverse options for businesses engaged in B2B transactions.

3) By Enterprise Size: Catering to All Sizes The market considers the enterprise size, addressing the unique needs of large enterprises, medium-sized enterprises, and small-sized enterprises.

4) By Industry Vertical: A Wide Spectrum B2B payments find applications across diverse industry verticals, including manufacturing, IT and telecom, metals and mining, energy and utilities, banking, financial services and insurance, government sector, and other industry verticals.

Regional Dominance: Asia-Pacific Leading the Charge

Market Leadership In 2022, Asia-Pacific emerged as the largest region in the B2B payments market, showcasing its dominance in this dynamic landscape.

Market Dynamics The prominence of Asia-Pacific can be attributed to a combination of factors, including the region’s robust economic activities, technological advancements, and the growing adoption of digital payment solutions.

Get A Free Sample On The Global B2B Payments Market Report:

https://www.thebusinessresearchcompany.com/sample_request?id=9045&type=smp

Read The Full B2B Payments Market Report Here:

https://www.thebusinessresearchcompany.com/report/b2b-payments-global-market-report

The B2B Payments Global Market Report 2023 provides an overview of the B2B payments market for the time series: historic years (2010 – 2021) and ten years forecast (2023 – 2032). The B2B payments market forecast analyzes B2B payments market size, B2B payments market share, leading competitor and their market positions.

The Table Of Content For The B2B Payments Market Include:

1. B2B Payments Market Executive Summary

2. B2B Payments Market Segments

3. B2B Payments Market Size And B2B Payments Market Growth Rate

4. Key B2B Payments Market Trends

5. Major B2B Payments Market Drivers

……

25. Key Mergers And Acquisitions In The B2B Payments Market

26. Top B2B Payments Companies

27. B2B Payments Market Opportunities And Strategies

28. B2B Payments Market, Conclusions And Recommendations

29. Appendix

Explore Similar Reports From The Business Research Company:

Payments Global Market Report 2023

Financial Services Global Market Report 2023

Lending And Payments Global Market Report 2023

Learn More About The Business Research Company

The Business Research Company has published over 6500+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model