What Are The 5 Top Insights From The Mobile Payment Technologies Market Forecast 2024

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

As per The Business Research Company’s Mobile Payment Technologies Global Market Report 2024, the mobile payment technologies market is expected to show significant growth in the forecast period.

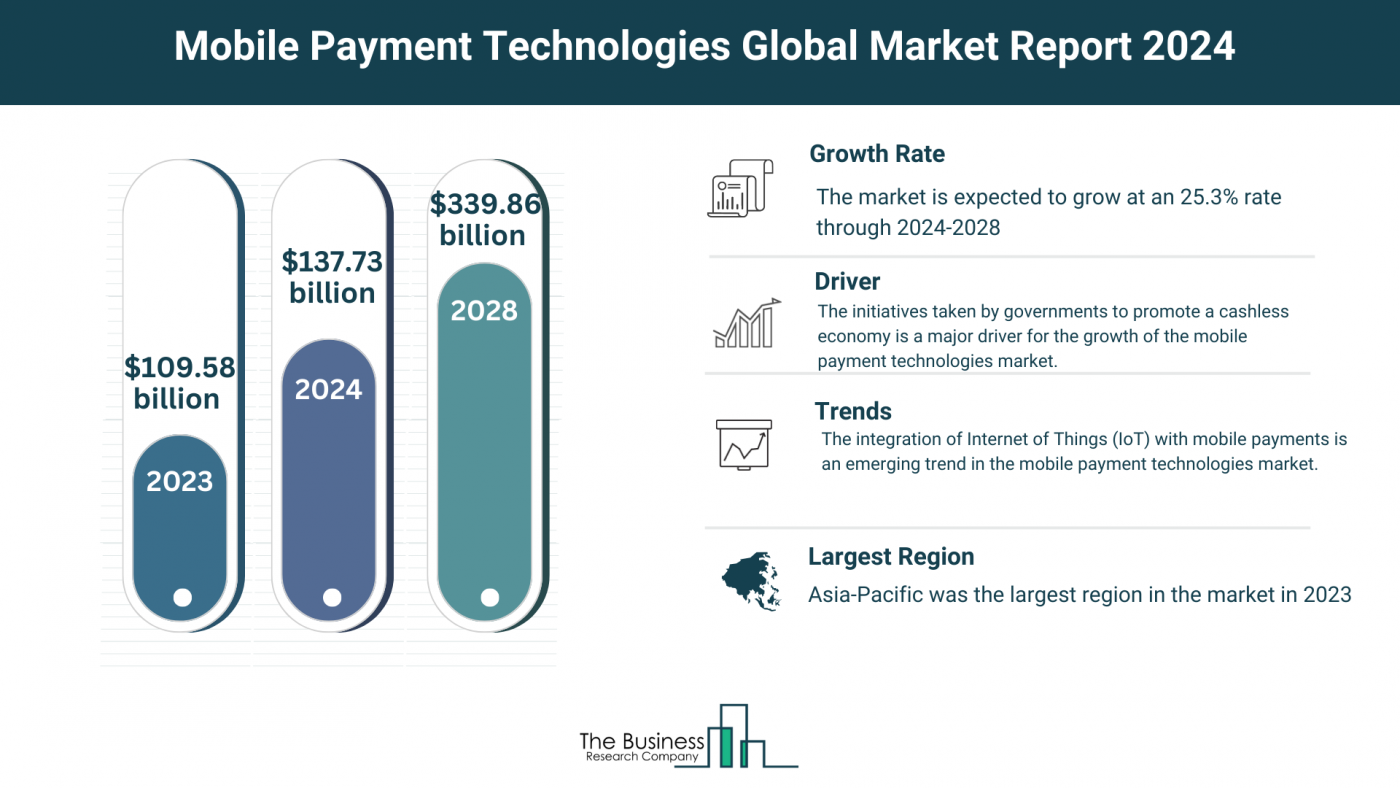

The mobile payment technologies market has witnessed remarkable growth, escalating from $109.58 billion in 2023 to a projected $137.73 billion in 2024, with a substantial Compound Annual Growth Rate (CAGR) of 25.7%. This surge is attributed to factors like increased smartphone penetration, the rise of digital wallets, consumer convenience, robust security measures, and the prevalence of contactless payments.

Anticipating Exponential Growth: A Prognosis for the Future Exponential Growth Trajectory: The mobile payment technologies market is poised for continued expansion, with expectations reaching $339.86 billion by 2028 at a CAGR of 25.3%. The forecasted growth is fueled by the persistent rise of contactless payments, increasing adoption in emerging markets, integration with the Internet of Things (IoT), and the prevalence of QR code payments. Major Trends in the Forecast Period: As the market progresses, key trends include the adoption of biometric authentication, the integration of blockchain and cryptocurrency, the rise of retailer-specific apps, and the expansion of IoT payments.

Regulations Propel Growth: The Impact of PSD2 Governance Through PSD2: Mobile payment technologies operate within the regulatory framework of the Payment Services Directives (PSD2), governing transactions across the European Union (EU) and the European Economic Area (EEA). PSD2 aims to create a unified payment landscape while encouraging non-banking entities to participate, fostering healthy competition. With a strong focus on enhancing security and customer protection, PSD2 plays a pivotal role in driving the secure expansion of mobile payment technologies.

View More On The Mobile Payment Technologies Market Report 2024 – https://www.thebusinessresearchcompany.com/report/mobile-payment-technologies-global-market-report

Industry Giants: Shaping the Future of Mobile Payments Key Industry Players: Major companies in the mobile payment technologies market include PayPal Holdings Inc., Mastercard Incorporated, Google LLC, Apple Inc., Vodacom Group Limited, and others. These industry leaders contribute significantly to innovation and the continual growth of the mobile payment ecosystem.

Innovative PIN on Mobile Technology: Enhancing User Experience PIN on Mobile Technology: Companies in the mobile payment technologies market are at the forefront of innovation, introducing technologies like PIN on mobile. Axis Bank, in March 2023, launched “MicroPay,” a PIN on mobile solution that transforms a retailer’s smartphone into a versatile Point-of-Sale (POS) terminal. This technology facilitates secure transactions, allowing customers to enter their PIN directly on the merchant’s smartphone, thereby simplifying digital payments and offering a unique customer experience.

Strategic Acquisitions: Strengthening Technological Infrastructure Razorpay’s Acquisition: In March 2022, RAZORPAY, a full-stack financial solutions provider based in India, acquired IZealiant Technologies to bolster its technological infrastructure. The acquisition empowers RAZORPAY to support banks with advanced technological solutions, elevating the overall end-user payment experience.

Market Segmentation and Regional Dynamics Comprehensive Segmentation: The mobile payment technologies market is segmented based on solutions (Point-Of Sale, In-Store Payments, Remote Payments), remote payments (Internet Payments, SMS Payments, Direct Carrier Billing, Mobile Banking), and applications (Retail & E-Commerce, Healthcare, BFSI, Enterprise). This segmentation offers insights into the diverse facets of the market. Regional Landscape: In 2023, the Asia-Pacific region dominated the mobile payment technologies market, with expectations of continued growth, making it the fastest-growing region during the forecast period.

Request A Sample Of The Global Mobile Payment Technologies Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=2523&type=smp

The Mobile Payment Technologies Global Market Report 2024 provides an in-depth analysis on the mobile payment technologies market size, trends and drivers, opportunities, strategies, and companies analysis. The countries covered in the mobile payment technologies market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Mobile Value Added Services Global Market Report 2024

Mobile Engagement Global Market Report 2024

Mobile Money Global Market Report 2024

Learn More About The Business Research Company

The Business Research Company has published over 3000+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model