Estimated Growth Potential Of The Retail Core Banking Solution Market 2023-2032

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

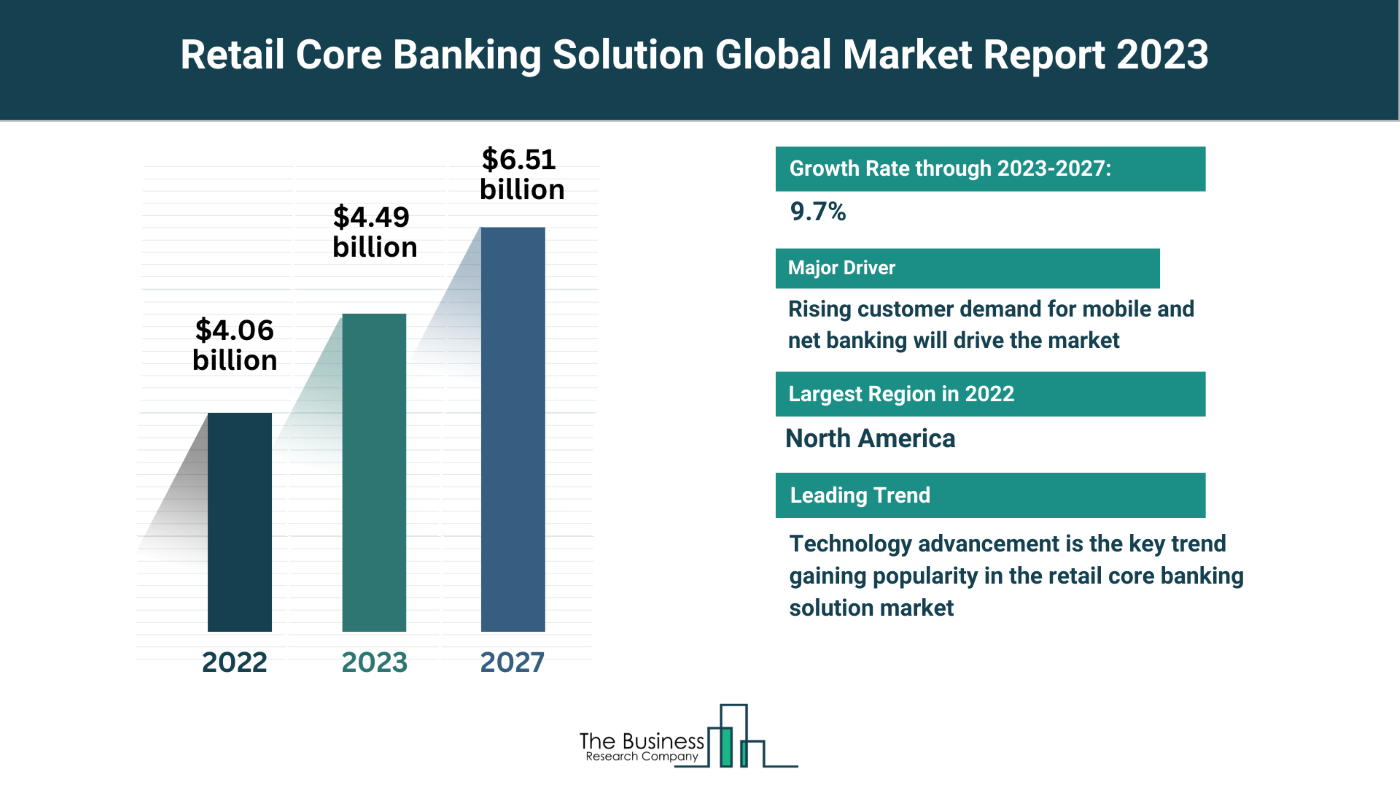

The global retail core banking solution market is poised for substantial growth, with projections indicating a climb from $4.06 billion in 2022 to $4.49 billion in 2023, reflecting a noteworthy Compound Annual Growth Rate (CAGR) of 10.5%. Beyond this, the market is anticipated to reach $6.51 billion by 2027, maintaining a robust CAGR of 9.7%. A pivotal driver of this growth is the escalating demand for mobile and net banking services.

Mobile and Net Banking: Catalysts for Growth

Transforming Customer Experience

The retail core banking solutions market is witnessing a significant surge, propelled by the rising customer demand for mobile and net banking. Mobile banking allows users to seamlessly manage their accounts and conduct financial activities using smartphones or tablets. Simultaneously, net banking enables clients to access a myriad of banking services and perform transactions online. The retail core banking solution acts as the linchpin, connecting net banking services with the regular operations of the bank, ensuring a harmonious flow across channels. As the global number of online banking users, including mobile and internet banking, is projected to reach 3.6 billion by 2024, the demand for retail core banking solutions is set to soar. In India alone, total digital transactions surged from 5,554 (Crore) in 2020–2021 to 8,840 (Crore) in 2021–2022, as reported by the National Payments Corporation of India (NCPI).

- Mobile and net banking demand fuels the growth of retail core banking solutions.

- Global online banking users set to reach 3.6 billion by 2024.

Market Pioneers: Shaping the Retail Core Banking Landscape

Key Players in the Industry

Major players are actively shaping the retail core banking solution market, contributing to its evolution and expanding its reach. Wells Fargo, Mambu GmbH, Oracle Corporation, SAP SE, and Tata Consultancy Services Limited, among others, play instrumental roles in defining the trajectory of this burgeoning market.

Tech Trends: Driving Innovation

Technology Advancements in Retail Core Banking

The retail core banking solution market is witnessing a prominent trend – the infusion of technology to drive innovation. Leading companies are strategically adopting cloud-native platforms and digital transformation tools to enhance their offerings. For instance, Arvest Bank, a US-based financial services company, launched a new lending service using Thought Machine’s cloud-native core banking technology. Leveraging the Vault Core banking platform, this technology eliminates inefficiencies in the over $1 trillion equipment finance market in the US. The application empowers Arvest Bank to differentiate its banking experience and create streamlined financial products for its customers.

- Technology advancements, including cloud-native platforms, redefine the retail core banking landscape.

- Arvest Bank leverages Thought Machine’s technology to revolutionize its lending service.

Market Dynamics: Strategic Segmentation

Tailoring Solutions for Varied Needs

The retail core banking solution market is strategically segmented to address diverse business needs and requirements. The segmentation includes components, deployment types, enterprise sizes, and applications, ensuring a nuanced approach to cater to the dynamic demands of the retail banking sector.

- By Component:

- Solution

- Services

- By Deployment:

- Cloud

- On-Premises

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application:

- Regulatory Compliance

- Risk Management

- Digital Banking

- Data Storage

- Other Applications

Global Landscape: Regional Dynamics

Leading the Charge and Emerging Strong

North America took the lead in the retail core banking solution market in 2022, showcasing its early adoption and prominence in the sector. Looking ahead, Asia-Pacific is anticipated to emerge as the fastest-growing region during the forecast period, signaling a global shift in the dynamics of retail core banking solutions adoption.

View More On The Retail Core Banking Solution Market Report 2023 – https://www.thebusinessresearchcompany.com/report/retail-core-banking-solution-global-market-report

Request A Sample Of The Global Retail Core Banking Solution Market Report 2023:

https://www.thebusinessresearchcompany.com/sample_request?id=11910&type=smp

The Retail Core Banking Solution Global Market Report 2023 provides comprehensive insights on the retail core banking solution market size, trends and drivers, opportunities, strategies, and competitor analysis. The countries covered in the retail core banking solution market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Digital Banking Platform Global Market Report 2023

RegTech Global Market Report 2023

Neobanking Global Market Report 2023

Learn More About The Business Research Company

The Business Research Company has published over 3000+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model