Understand How The Wealth Management Platform Market Is Set To Grow In Through 2024-2033

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

The wealth management platform market has experienced significant growth in recent years, driven by various factors including digitalization, data security concerns, and the rising number of high-net-worth individuals (HNWIs). This blog explores the key drivers, trends, and notable developments within the industry, highlighting the future growth prospects of the market.

Market Growth Overview

Recent Growth

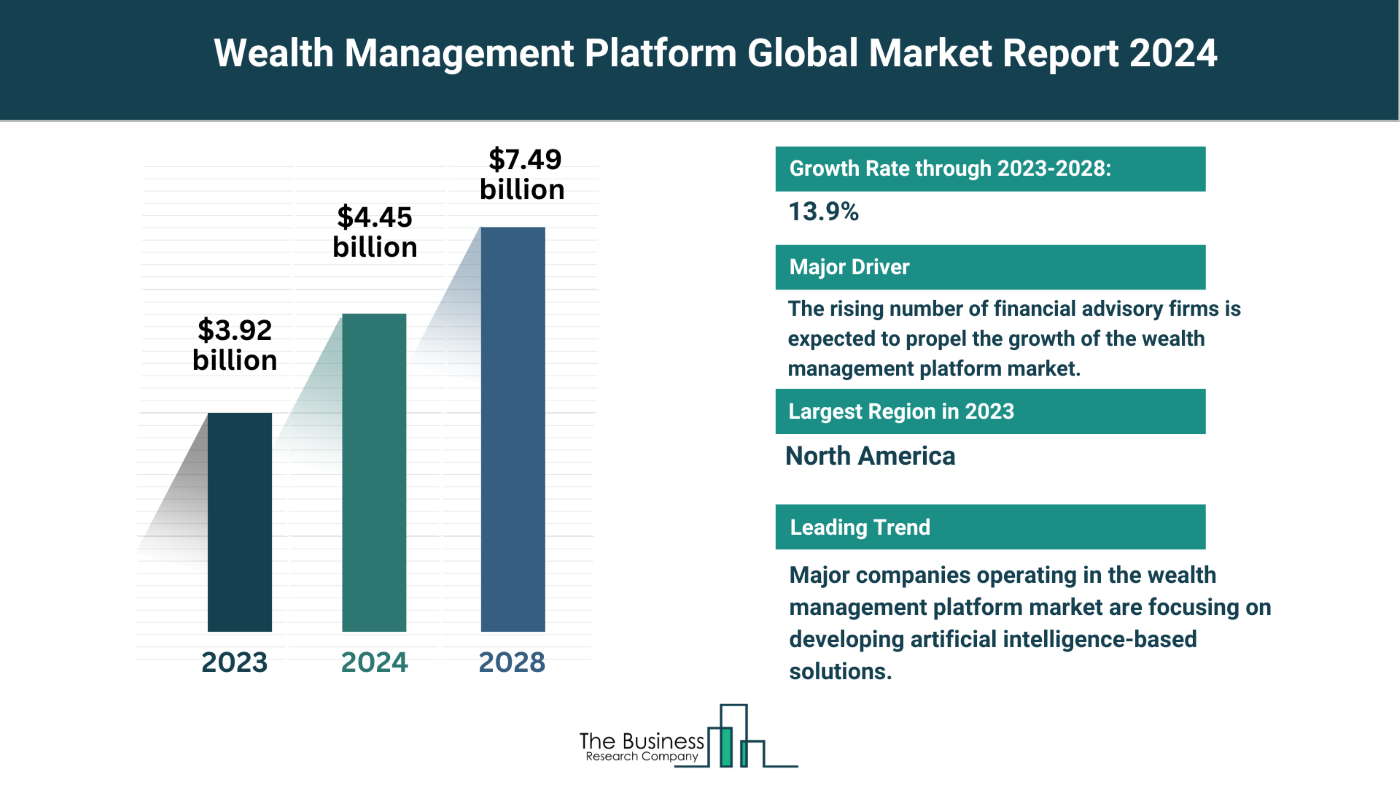

- Market Size in 2023: $3.92 billion

- Expected Market Size in 2024: $4.45 billion

- CAGR (2023-2024): 13.5%

- Growth Drivers:

- Increase in HNWIs globally

- Growing digitalization across the financial sector

- Rising concerns about data security and bank safety

- Adoption of blockchain technology

- Stringent government regulations in the financial sector

Future Projections

- Expected Market Size in 2028: $7.49 billion

- CAGR (2024-2028): 13.9%

- Growth Drivers:

- Increased adoption of cloud-based solutions

- Need for improved customer experience in financial firms

- High adoption of automation

- Enhanced security and data protection measures

Key Trends and Innovations

Innovative Wealth Management Platforms

- Emphasis on user-friendly interfaces and comprehensive features

- Customizable solutions to cater to diverse client needs

Real-Time Analytics and Adaptable Investment Strategies

- Utilization of real-time data for informed decision-making

- Flexible investment strategies that adjust to market conditions

Technological Innovations

- Integration of AI and machine learning for predictive analytics

- Blockchain for enhanced security and transparency

Amalgamating Progressive Technologies

- Combining various advanced technologies to create holistic solutions

- Continuous improvement and innovation in platform capabilities

Read The Full Wealth Management Platform Market Report Here:

https://www.thebusinessresearchcompany.com/report/wealth-management-platform-global-market-report

Rising Number of Financial Advisory Firms

Impact on Market Growth

- Definition: Businesses providing expert financial guidance to individuals and institutions

- Growth Drivers:

- Demand for personalized financial guidance

- Services including retirement planning, investment management, tax optimization, and estate planning

Statistics and Trends

- Investment Adviser Association Report (2023):

- 54.3 million clients in 2022 utilizing asset management advisory services, a 2.1% increase from the previous year

- Notable rise in SEC-registered investment advisory firms in 2021, reaching 14,806 firms, a 6.7% increase

Role of Wealth Management Platforms

- Streamlining client interactions

- Enhancing service delivery and portfolio management

- Providing comprehensive financial solutions tailored to client needs

Major Companies and Innovations

Leading Companies

- Key Players: JPMorgan Chase & Co, Bank of America Corporation, Tata Consultancy Services Ltd., NEC Corporation, PNC Financial Services Group Inc., Infosys Limited, BlackRock Inc., Fiserv Inc., Goldman Sachs Private Wealth Management, Fidelity Information Services Inc., Vanguard Group Inc., Northern Trust Corporation, Broadridge Financial Solutions Inc., SS&C Technologies Inc., Charles Schwab Investment Management Inc., SEI Investments Company, Temenos AG, Comarch SA, Backbase BV, Prometeia SpA, Crealogix AG, Profile Systems and Software SA, Dreamplug Technologies Private Limited, Wells Fargo Investment Institute Inc., Tinwell Labs Inc

AI-Powered Platforms to Address Growing Financial Stress

- Example: Era, an AI-powered wealth management platform by Tinwell Labs Inc., launched in November 2023

- Features: Personalizes wealth management advice, automates financial tasks, incorporates market news and macroeconomic data

Strategic Acquisitions

- Backbase BV Acquires Nucoro Limited:

- Date: June 2023

- Purpose: Integrate Nucoro’s headless platform capabilities into Backbase’s offerings

- Impact: Enable customers to launch digital investment services like robo-advisory and trading

Market Segmentation

By Deployment Type

- On-Premises

- Cloud

By Advisory Mode

- Human Advisory

- Robo Advisory

- Hybrid

By Business Function

- Financial Advice Management

- Portfolio, Accounting, and Trading Management

- Performance Management

- Risk and Compliance Management

- Reporting

- Other Business Functions

By End-User

- Banks

- Trading Firms

- Brokerage Firms

- Investment Management Firms

- Other End-Users

Regional Insights

North America

- Largest Region in 2023

Asia-Pacific

- Fastest-Growing Region in the Forecast Period

Conclusion

The wealth management platform market is on a robust growth trajectory, driven by technological advancements, rising demand for personalized financial services, and the increasing number of financial advisory firms. As the market continues to evolve, innovations such as AI-powered platforms and strategic acquisitions will further bolster its expansion, making it an exciting industry to watch in the coming years.

Get A Free Sample On The Global Wealth Management Platform Market Report:

https://www.thebusinessresearchcompany.com/sample_request?id=14821&type=smp

The Wealth Management Platform Global Market Report 2024 provides an overview of the wealth management platform market for the time series: historic years (2010 – 2021) and ten years forecast (2023 – 2032). The wealth management platform market forecast analyzes wealth management platform market size, wealth management platform market share, leading competitor and their market positions.

The Table Of Content For The Wealth Management Platform Market Include:

1. Wealth Management Platform Market Executive Summary

2. Wealth Management Platform Market Segments

3. Wealth Management Platform Market Size And Wealth Management Platform Market Growth Rate

4. Key Wealth Management Platform Market Trends

5. Major Wealth Management Platform Market Drivers

……

25. Key Mergers And Acquisitions In The Wealth Management Platform Market

26. Top Wealth Management Platform Companies

27. Wealth Management Platform Market Opportunities And Strategies

28. Wealth Management Platform Market, Conclusions And Recommendations

29. Appendix

Explore Similar Reports From The Business Research Company:

Wealth Management Global Market Report 2024

Cloud Management Platform Global Market Report 2024

Event Management Platform Global Market Report 2024

Learn More About The Business Research Company

The Business Research Company has published over 6500+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: