Global Trade Finance Market Analysis: Size, Drivers, Trends, Opportunities And Strategies

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

Market Growth Overview

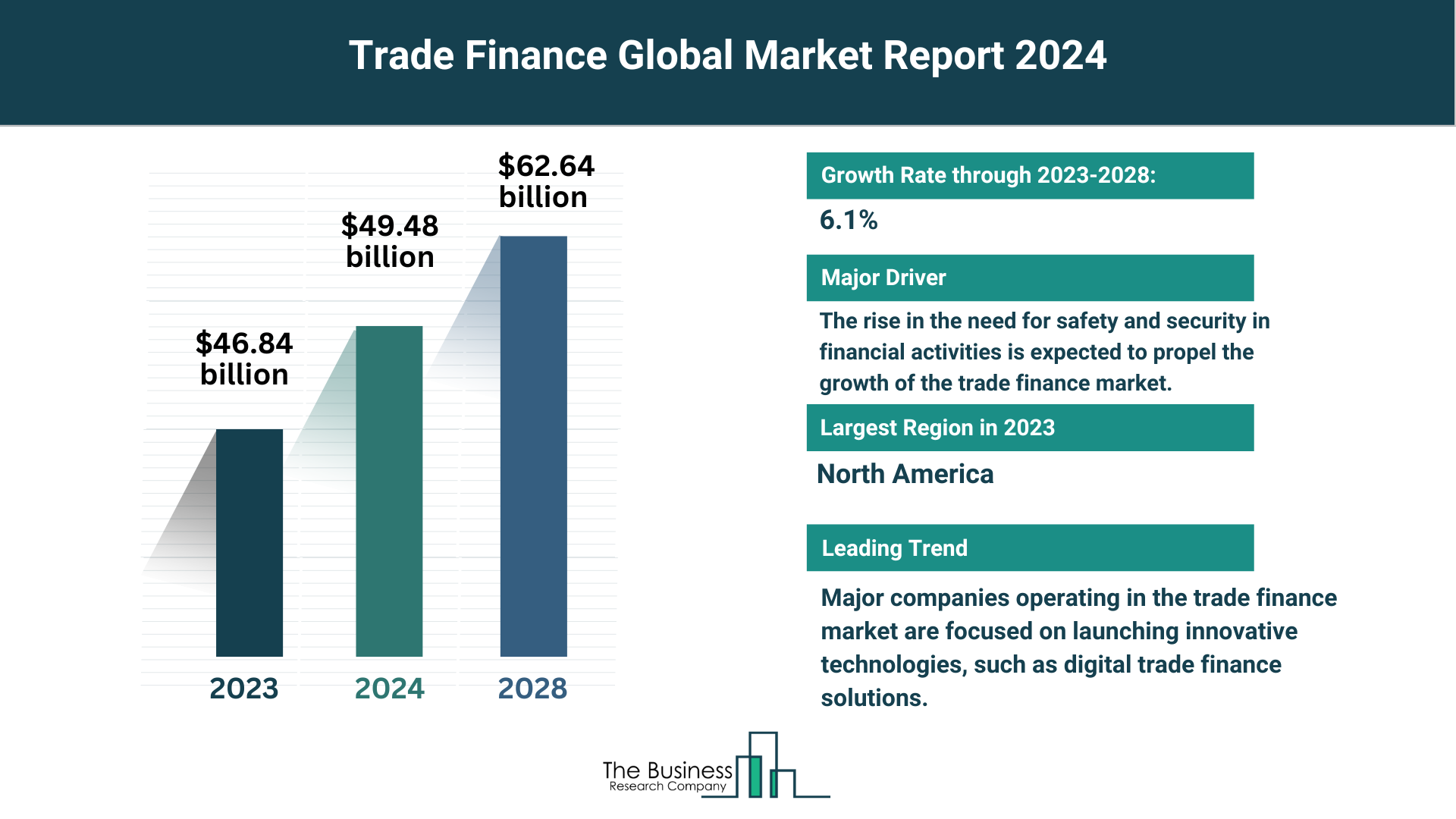

The trade finance market has demonstrated robust growth in recent years:

- 2023: Market size reached $46.84 billion.

- 2024: Projected to grow to $49.48 billion, with a CAGR of 5.6%.

Historical Growth Drivers

Several factors have contributed to this historical growth:

- Globalization: Increased global trade activities.

- Regulatory Changes: Evolving regulations impacting trade finance.

- Economic Uncertainty: Businesses seeking stable financial solutions.

- Supply Chain Dynamics: Shifts necessitating more efficient trade finance solutions.

Future Market Projections

The trade finance market is expected to maintain its upward trend:

- 2028: Expected to grow to $62.64 billion, with a CAGR of 6.1%.

Future Growth Drivers

Key factors anticipated to drive future growth include:

- Structuring and Pricing Tools: Advanced tools for better trade finance management.

- Emerging Markets: Growth in emerging economies.

- Sustainable Trade and ESG: Increasing focus on environmental, social, and governance criteria.

- Geopolitical Developments: Impact of global trade policies.

- Supply Chain Resilience: Enhanced risk management practices.

Emerging Trends

Several significant trends are set to shape the future of the trade finance market:

- Blockchain Integration: Enhancing transparency and security.

- Digital Transformation: Adoption of digital trade finance solutions.

- AI and ML: Leveraging artificial intelligence and machine learning for improved efficiency.

- Technological Advancements: Continuous evolution in trade finance technology.

- Cross-Border Payment Innovations: New methods for facilitating international trade payments.

Read The Full Trade Finance Market Report Here:

https://www.thebusinessresearchcompany.com/report/trade-finance-global-market-report

Rising Financial Security Concerns

The increasing need for security in financial activities is driving the growth of the trade finance market:

- Financial Security: Measures to safeguard transactions from fraud and theft.

- Trade Finance Solutions: Secure payment mechanisms and trade credit options.

- Fraud Prevention: Significant rise in fraud losses necessitating better security measures.

For instance, the Federal Trade Commission reported over $10 billion in consumer fraud losses in 2023, a 14% increase from 2022, highlighting the critical need for secure financial activities.

Key Players in the Trade Finance Market

Several major companies are leading the trade finance market:

- JPMorgan Chase & Co.

- China Construction Bank

- Bank of America Corporation

- Citigroup Inc.

- BNP Paribas S.A.

- HSBC Holdings plc

- Mitsubishi UFJ Financial Inc.

- Credit Agricole Group

- Deutsche Bank AG

- Standard Chartered plc

- Others including regional and specialized institutions.

Innovative Digital Trade Finance Solutions

Major companies are launching innovative digital trade finance solutions to gain a competitive edge:

Example: HSBC TradePay

- Launch: September 2023 by HSBC.

- Features: Digital solution for faster, simpler supplier payments.

- Benefits: Improved working capital and strengthened trading partner relationships.

Example: Xalts Acquires Contour Network

- Acquisition: February 2024 by Xalts.

- Purpose: Combine Xalts’ digital finance expertise with Contour’s global network.

- Benefits: Simplified communication and transactions between enterprises and financial institutions.

Market Segmentation

The trade finance market is segmented into various categories:

- By Type:

- Supply Chain Finance

- Structured Trade Finance

- Traditional Trade Finance

- By Service Provider:

- Banks

- Financial Institutions

- Trading Houses

- Other Services

- By Application:

- Domestic

- International

- By Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Construction

- Wholesale or Retail

- Manufacturing

- Automobile

- Shipping and Logistics

- Other Industries

Regional Insights

- North America: Largest region in the trade finance market in 2023.

- Asia-Pacific: Expected to be the fastest-growing region during the forecast period.

The trade finance market is on a path of significant growth, driven by technological advancements, increasing globalization, and a heightened focus on security and efficiency. With continuous innovations and a keen eye on emerging trends, the market is poised to offer robust solutions to meet the evolving needs of global trade.

Get A Free Sample On The Global Trade Finance Market Report:

https://www.thebusinessresearchcompany.com/sample_request?id=14812&type=smp

The Trade Finance Global Market Report 2024 provides an overview of the trade finance market for the time series: historic years (2010 – 2021) and ten years forecast (2023 – 2032). The trade finance market forecast analyzes trade finance market size, trade finance market share, leading competitor and their market positions.

Explore Similar Reports From The Business Research Company:

Trade Management Software Global Market Report 2024

Personal Finance Software Global Market Report 2024

Supply Chain Finance Global Market Report 2024

Learn More About The Business Research Company

The Business Research Company has published over 6500+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: