Letter Of Credit Confirmation Market Outlook 2024-2033: Growth Potential, Drivers And Trends

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

Introduction: The Dynamics of Expansion

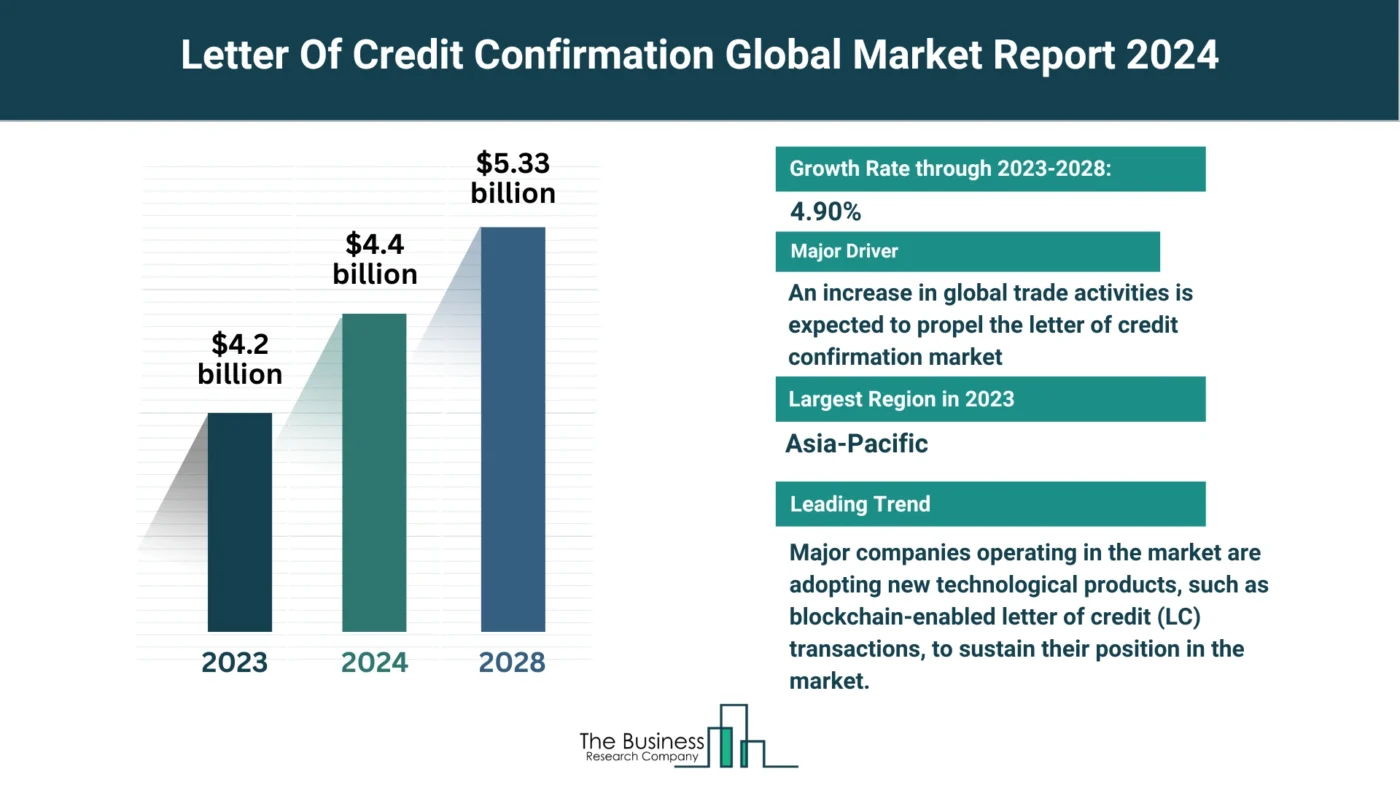

- Steady Growth Trajectory: The letter of credit confirmation market has exhibited consistent growth, with promising projections for the future.

- Market Size Analysis: From $4.2 billion in 2023 to an estimated $4.4 billion in 2024, reflecting a Compound Annual Growth Rate (CAGR) of 4.9%.

Factors Fueling Growth

- Complexity of International Transactions

- Navigating Complexity: International transactions pose unique challenges necessitating secure financial instruments like letters of credit.

- Risk Mitigation: Letters of credit offer assurance amid complex cross-border dealings, enhancing trust and facilitating transactions.

- Regulatory Compliance and Creditworthiness Concerns

- Ensuring Compliance: Stringent regulations drive demand for confirmed letters of credit, ensuring adherence to legal frameworks.

- Enhanced Credibility: Confirmations mitigate credit risks, bolstering confidence among trading partners.

- Currency Exchange Risks and Economic Stability

- Managing Currency Fluctuations: Volatility in exchange rates underscores the importance of secured financial mechanisms.

- Economic Stability: Stable economies foster trade confidence, amplifying the need for reliable financial instruments.

- Expansion of Global Supply Chains

- Global Integration: Supply chains span continents, necessitating robust financial instruments for seamless transactions.

- Risk Management: Confirmations mitigate risks associated with extended supply chains, ensuring smooth operations.

Projections for the Future

- Regulatory Landscape and Trade Policy Shifts

- Adapting to Change: Evolving regulations and trade policies reshape the landscape, influencing market dynamics.

- Opportunities Amidst Challenges: Agility in response to regulatory shifts presents avenues for innovation and growth.

- Emergence of Alternative Financing Solutions

- Diversifying Options: Alternative financing avenues offer flexibility and efficiency, driving adoption in diverse industries.

- Enhanced Accessibility: Accessibility of alternative solutions fosters inclusivity and broadens market reach.

- Digital Transformation and Blockchain Integration

- Harnessing Technological Advancements: Digitalization revolutionizes trade finance, streamlining processes and enhancing transparency.

- Blockchain Innovations: Blockchain-enabled transactions offer security and efficiency, transforming traditional practices.

View More On The Letter Of Credit Confirmation Market Report 2024 – https://www.thebusinessresearchcompany.com/report/letter-of-credit-confirmation-global-market-report

Industry Highlights

- Citi India’s Blockchain Initiative

- Streamlining Trade Processes: Blockchain-enabled letter of credit transactions revolutionize trade finance, reducing processing time and enhancing efficiency.

- Pioneering Solutions: Citi India’s adoption of blockchain showcases industry leadership and commitment to innovation.

- Mizuho Bank’s Strategic Acquisition

- Expansion and Strengthening: Acquisition of Capstone Partners bolsters Mizuho’s capabilities in capital raising and advisory services.

- Driving Innovation: Consolidation of resources enhances Mizuho’s portfolio, enabling innovative solutions for clients.

Market Segmentation

- By L/C Type: Segmented into Sight L/Cs and Usance L/Cs to cater to varied trade needs.

- By End User: Tailored solutions for Small, Medium, and Large Enterprises to meet diverse requirements.

Regional Insights

- Dominance of Asia-Pacific: Asia-Pacific emerges as a key player in the letter of credit confirmation market, driven by burgeoning trade activities.

Conclusion: Navigating the Path Ahead

- Continuous Evolution: The letter of credit confirmation market thrives on adaptation and innovation, poised for sustained growth.

- Adopting Innovation: Embracing technological advancements and market trends is crucial for staying competitive in the dynamic landscape of trade finance.

Request A Sample Of The Global Letter Of Credit Confirmation Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=9087&type=smp

The Letter Of Credit Confirmation Global Market Report 2024 provides comprehensive insights on the letter of credit confirmation market size, trends and drivers, opportunities, strategies, and competitor analysis. The countries covered in the letter of credit confirmation market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Credit Card Global Market Report 2024

Payments Global Market Report 2024

Financial Services Global Market Report 2024

Learn More About The Business Research Company

The Business Research Company has published over 6500+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: