Global IoT Insurance Market Report 2024: Size, Drivers, And Top Segments

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

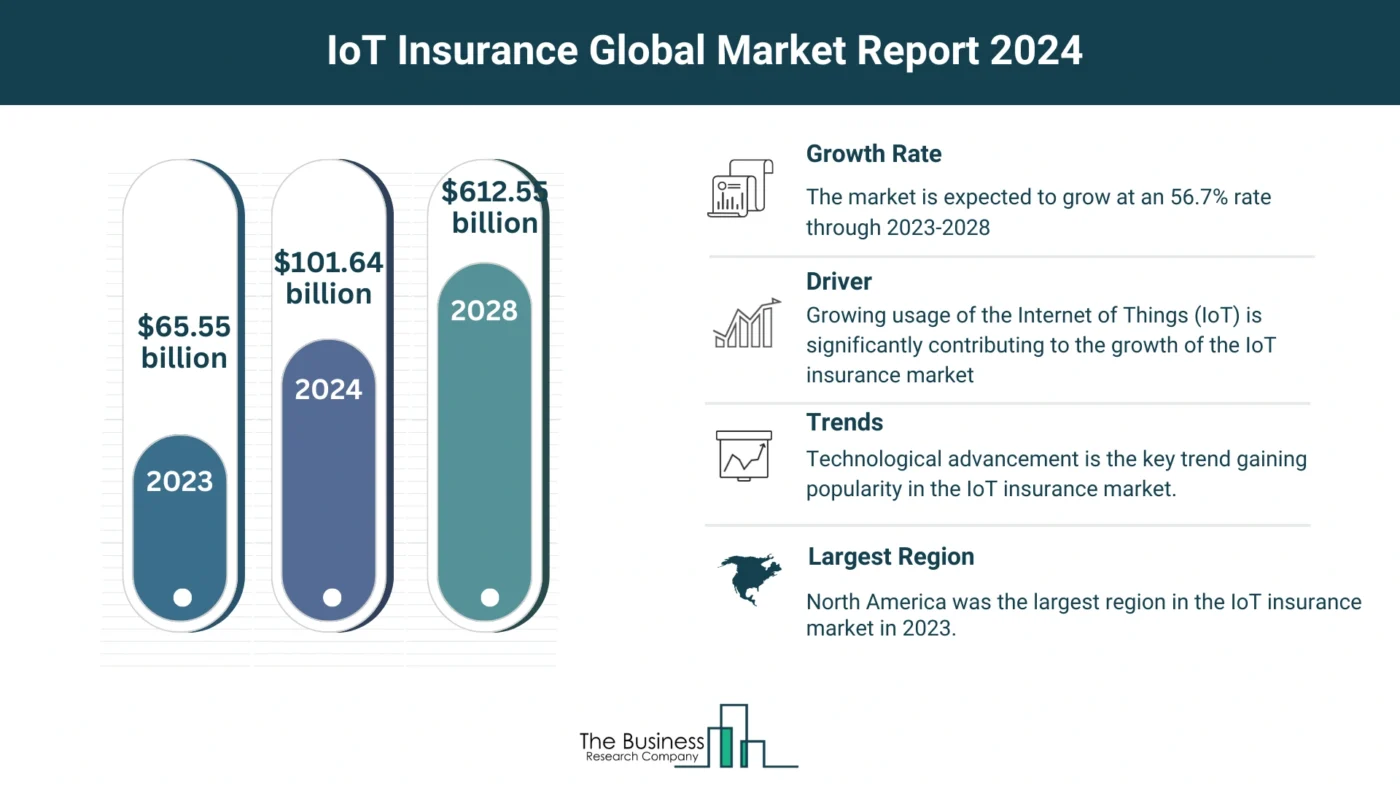

The IoT insurance market has witnessed explosive growth in recent years, fueled by a myriad of factors driving innovation and demand. From 2023 to 2024, the market size surged from $65.55 billion to $101.64 billion at a remarkable compound annual growth rate (CAGR) of 55.0%. This momentum is projected to continue, with forecasts anticipating a surge to $612.55 billion by 2028, boasting a CAGR of 56.7%. Let’s delve into the driving forces behind this remarkable trajectory.

Driving Forces Behind IoT Insurance Market Growth

- Risk Prevention and Mitigation:

- IoT facilitates proactive risk identification and mitigation strategies.

- Enhanced Customer Engagement:

- Personalized services and real-time insights improve customer satisfaction.

- Home Automation Devices:

- Integration of smart home devices enhances property monitoring and risk management.

- Health and Wearable Devices:

- IoT-enabled health devices promote healthier lifestyles and enable proactive health management.

- Smart Property Devices:

- Devices like smart thermostats and security systems enhance property safety and insurance coverage.

- Cybersecurity Concerns:

- Growing cyber threats drive demand for IoT-enabled cybersecurity solutions.

View More On The IoT Insurance Market Report 2024 – https://www.thebusinessresearchcompany.com/report/iot-insurance-global-market-report

IoT Adoption Drives IoT Insurance Market Growth

Empowering Insurance Through IoT

The proliferation of the Internet of Things (IoT) is a significant catalyst for the expansion of the IoT insurance market. IoT technology enables the seamless connectivity of physical items equipped with sensors and software, revolutionizing risk assessment and customer engagement. With a staggering 61% year-on-year growth in IoT adoption from 2020 to 2021, its utilization is poised to fuel market growth further.

Technological Revolution Drives Innovation in IoT Insurance

Embracing Technological Advancements

Technological innovation lies at the heart of IoT insurance market evolution. Key industry players are investing in cutting-edge technologies to elevate IoT applications within the insurance sector. For instance, ARMD’s introduction of the Smart Van Alarm and Tracker demonstrates the transformative potential of IoT in insurance. This self-installed IoT device enhances security, streamlines claims processing, and empowers insurers with valuable underwriting data.

Lemonade Expands Its IoT Presence With Acquisition Of Metromile

Driving Consolidation and Expansion

In September 2022, Lemonade Inc. made waves with its acquisition of Metromile for $145 million, signaling a strategic move to bolster its IoT capabilities. Metromile’s IoT-driven car sensors, coupled with AI-powered mileage monitoring, align seamlessly with Lemonade’s commitment to leveraging technology for insurance innovation.

Segmentation and Regional Landscape

Understanding Market Dynamics

The IoT insurance market is segmented across various dimensions, including components, insurance types, and applications. Notable segments include solutions and services, life and health insurance, property and casualty insurance, and diverse application areas spanning automotive transportation to agriculture. North America emerged as the dominant region in 2023, underscoring the region’s pivotal role in driving market expansion.

Charting the Course Ahead

Anticipating Future Trends

As the IoT insurance market continues its upward trajectory, stakeholders must remain vigilant to emerging trends and technological advancements. Integration of connected devices, telematics in auto insurance, and the convergence of IoT with cybersecurity are poised to shape the industry landscape. With a relentless focus on innovation and customer-centric solutions, the IoT insurance market is poised for unprecedented growth and transformation in the years to come.

Request A Sample Of The Global IoT Insurance Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=9229&type=smp

The IoT Insurance Global Market Report 2024 provides comprehensive insights on the IoT insurance market size, trends and drivers, opportunities, strategies, and competitor analysis. The countries covered in the IoT insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

IOT Sensors Global Market Report 2024

IoT Services Global Market Report 2024

Insurance Global Market Report 2024

Learn More About The Business Research Company

The Business Research Company has published over 6500+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: