5 Major Insights On The Derivatives & Commodities Brokerage Market 2024

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

As per The Business Research Company’s Derivatives & Commodities Brokerage Global Market Report 2024, the derivatives & commodities brokerage market is expected to show significant growth in the forecast period.

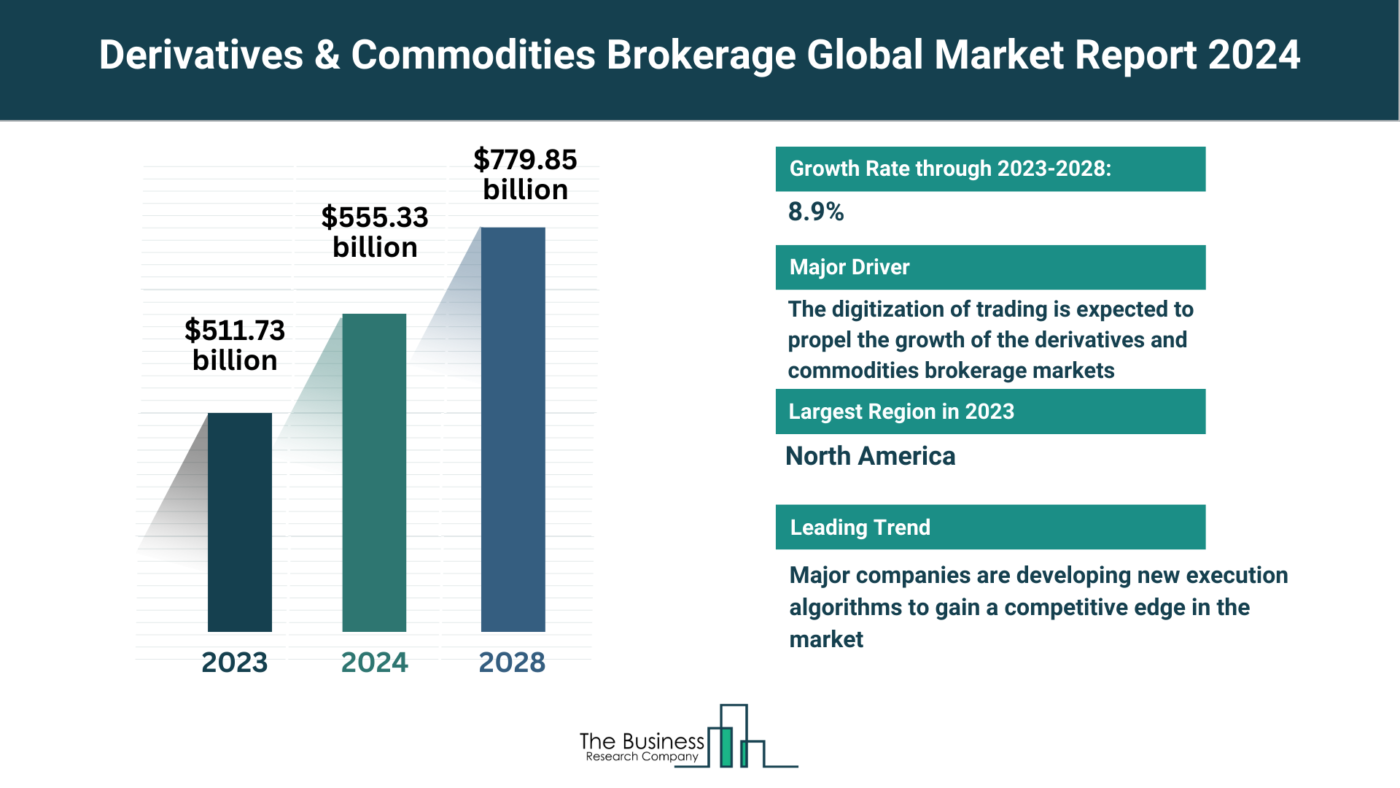

The derivatives & commodities brokerage market has experienced robust growth, with the market size reaching $511.73 billion in 2023 and projected to grow to $555.33 billion in 2024, boasting a compound annual growth rate (CAGR) of 8.5%.

Drivers of Growth in the Historic Period

The growth in recent years can be attributed to various factors:

- Market globalization and integration

- Financial market innovations

- Risk management needs

- Economic growth and industrial demand

- Regulatory changes and compliance measures

Future Projections

Expectations indicate continued strong growth, with the market anticipated to expand to $779.85 billion in 2028, reflecting a CAGR of 8.9%. This growth trajectory is influenced by several emerging trends and factors.

View More On The Derivatives & Commodities Brokerage Market Report 2024 – https://www.thebusinessresearchcompany.com/report/derivatives-and-commodities-brokerage-global-market-report

Rising Digitization of Trading Fueling Market Growth

The Impact of Digital Trading

Digital trading is becoming increasingly significant, enabling nearly fully online buying and selling of securities. This trend offers benefits such as:

- Accessibility for monitoring investments

- Faster transactions

- Cost-effectiveness

Contributions to the Economy

The digital sector has made substantial contributions to economies worldwide. For instance:

- In the UK, the digital sector contributed £151 billion ($197 billion) to the economy in November 2021, representing a significant portion of global GDP.

- The shift towards digitization is a driving force behind the growth of the derivatives and commodities brokerage market.

Product Innovations Transforming the Market

Development of Trading Systems

Major companies in the market are focusing on developing innovative derivatives trading systems to maintain their competitive edge. Recent developments include:

- Launching new derivatives trading systems with enhanced features and capabilities.

- Introducing new products and rule revisions to cater to evolving market needs.

Acquisitions for Expansion

Companies are also leveraging acquisitions to bolster their offerings and market presence:

- Marex’s acquisition of Volcap Trading in September 2021 aimed to enhance its commodities offering.

- This strategic move allows for increased product selection and seamless integration of operations, benefiting clients of both entities.

Segmentation and Regional Insights

Market Segmentation

The derivatives & commodities brokerage market is segmented based on:

- Type (Commodity Brokerage, Derivative Brokerage)

- Brokers (Futures Commission Merchants, Introducing Brokers, etc.)

- Derivative Contract (Options, Futures, Forwards, Swaps)

- Application (Futures Company, Securities Company, Bank Institutions)

Regional Dynamics

North America emerged as the largest region in the derivatives and commodities brokerage market in 2023, indicating significant market dominance in this region.

Conclusion: Embracing Growth Opportunities

The derivatives & commodities brokerage market is poised for substantial growth, driven by factors like digitization, product innovations, and market expansion. As companies adapt to evolving trends and consumer demands, opportunities for further development and expansion abound in this dynamic sector. With a focus on technological advancements, regulatory compliance, and customer-centric solutions, stakeholders can navigate this evolving landscape and capitalize on the lucrative prospects it offers.

Request A Sample Of The Global Derivatives & Commodities Brokerage Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=9550&type=smp

The Derivatives & Commodities Brokerage Global Market Report 2024 provides an in-depth analysis on the derivatives & commodities brokerage market size, trends and drivers, opportunities, strategies, and companies analysis. The countries covered in the derivatives & commodities brokerage market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Cloud Services Global Market Report 2024

Cloud Security Global Market Report 2024

Cloud Billing Global Market Report 2024

Learn More About The Business Research Company

The Business Research Company has published over 3000+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company:https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn:https://in.linkedin.com/company/the-business-research-company

YouTube:https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model:https://www.thebusinessresearchcompany.com/global-market-model