Digital Twin Financial Services And Insurance Market Outlook 2024-2033: Growth Potential, Drivers And Trends

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

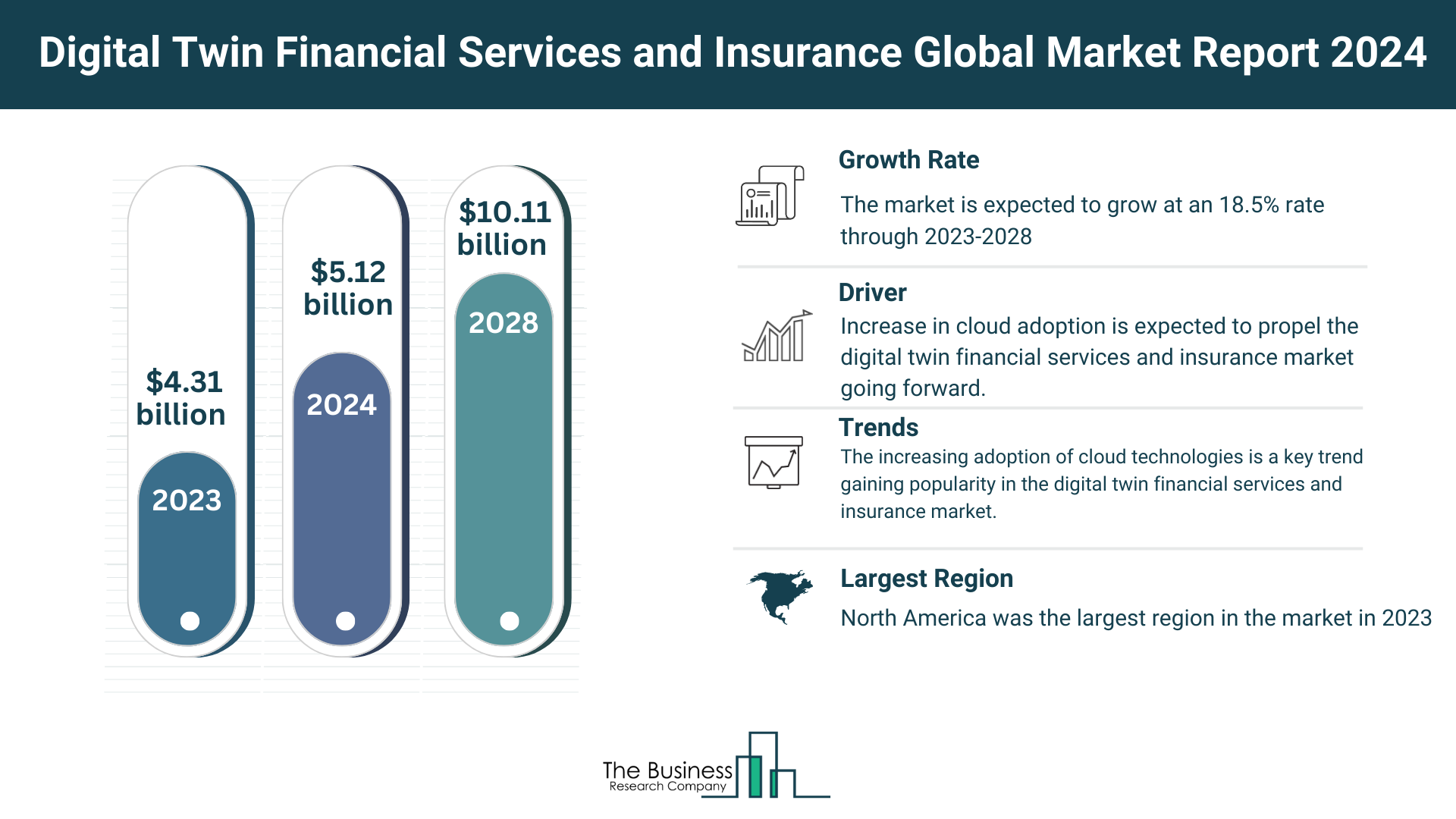

The digital twin financial services and insurance market size has grown rapidly in recent years, reaching $4.31 billion in 2023 and projected to hit $5.12 billion in 2024, with a compound annual growth rate (CAGR) of 18.9%.

- Increased volume of financial data and advances in data analytics drive market growth.

- Regulatory compliance and risk management needs, alongside digital transformation in financial services, contribute to expansion.

- Insurtech innovations also play a significant role in market dynamics.

Rapid Growth Forecasted

Expectations are high for the digital twin financial services and insurance market, slated to reach $10.11 billion by 2028, with a CAGR of 18.5%.

- Blockchain adoption for transparent financial transactions and personalized financial planning solutions drive growth.

- Digital twins are increasingly used for fraud detection and real-time analytics in financial services.

- Tokenization and digital assets further expand the market landscape.

Major Trends in Forecast Period

The upcoming trends in the digital twin financial services and insurance market encompass various technological integrations and applications.

- Integration of artificial intelligence into digital twins enhances capabilities.

- Simulation-based scenario planning gains prominence in finance.

- Digital twins find applications in customer journey mapping in insurance.

- Cybersecurity simulation and threat detection become critical.

- Integration with robotic process automation (RPA) enhances operational efficiency.

Cloud Adoption Propels Market Growth

The surge in cloud adoption emerges as a significant driver for the digital twin financial services and insurance market.

- Digital twin technology facilitates cloud adoption by replicating financial processes and assets.

- Cloud scalability, accessibility, and cost-efficiency support real-time data analysis and remote monitoring.

- Enhanced data security and compliance are achieved through cloud-based solutions.

Matera’s Digital Twin Solution Paves the Way to Cloud Transformation

Major companies in the market are innovating to sustain their positions, exemplified by Matera’s Digital Twin solution.

- Designed as a cloud-native software, Matera’s solution accelerates digital transformation in financial institutions.

- The solution offers flexibility in cloud infrastructure selection, reducing risks associated with dependency on a single provider.

- It ensures the security and adaptability of digital transactions while lowering operating expenses.

Siemens Smart Infrastructure Acquires Ecodomus Digital Twin Software Platform

In December 2021, Siemens Smart Infrastructure expanded its digital building offerings by acquiring EcoDomus’s digital twin software platform.

- The acquisition enables Siemens to offer cloud-based building operations twin software.

- EcoDomus’s expertise in digital twin software aligns with Siemens’ smart infrastructure objectives.

View More On The Digital Twin Financial Services And Insurance Market Report 2024 – https://www.thebusinessresearchcompany.com/report/digital-twin-financial-services-and-insurance-global-market-report

Segmentation of the Market

The digital twin financial services and insurance market is segmented based on type, technology, deployment, and application.

- Types include System Digital Twin and Process Digital Twin.

- Technologies encompass IoT, AI, 5G, big data analytics, blockchain, and mixed reality.

- Deployment options include cloud and on-premises solutions.

- Applications range from fund checking to policy generation.

Regional Insights

North America led the digital twin financial services and insurance market in 2023, with Asia-Pacific expected to be the fastest-growing region in the forecast period.

- The market’s geographical dynamics reflect the global expansion of digital twin technologies in financial services and insurance sectors.

Request A Sample Of The Global Digital Twin Financial Services And Insurance Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=7671&type=smp

The Digital Twin Financial Services And Insurance Global Market Report 2024 provides comprehensive insights on the digital twin financial services and insurance market size, trends and drivers, opportunities, strategies, and competitor analysis. The countries covered in the digital twin financial services and insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Digital Payments Global Market Report 2024

Blockchain Technologies Global Market Report 2024

Artificial Intelligence Services Global Market Report 2024

Learn More About The Business Research Company

The Business Research Company has published over 3000+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model