Estimated Growth Potential Of The Core Banking Software Market 2024-2033

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

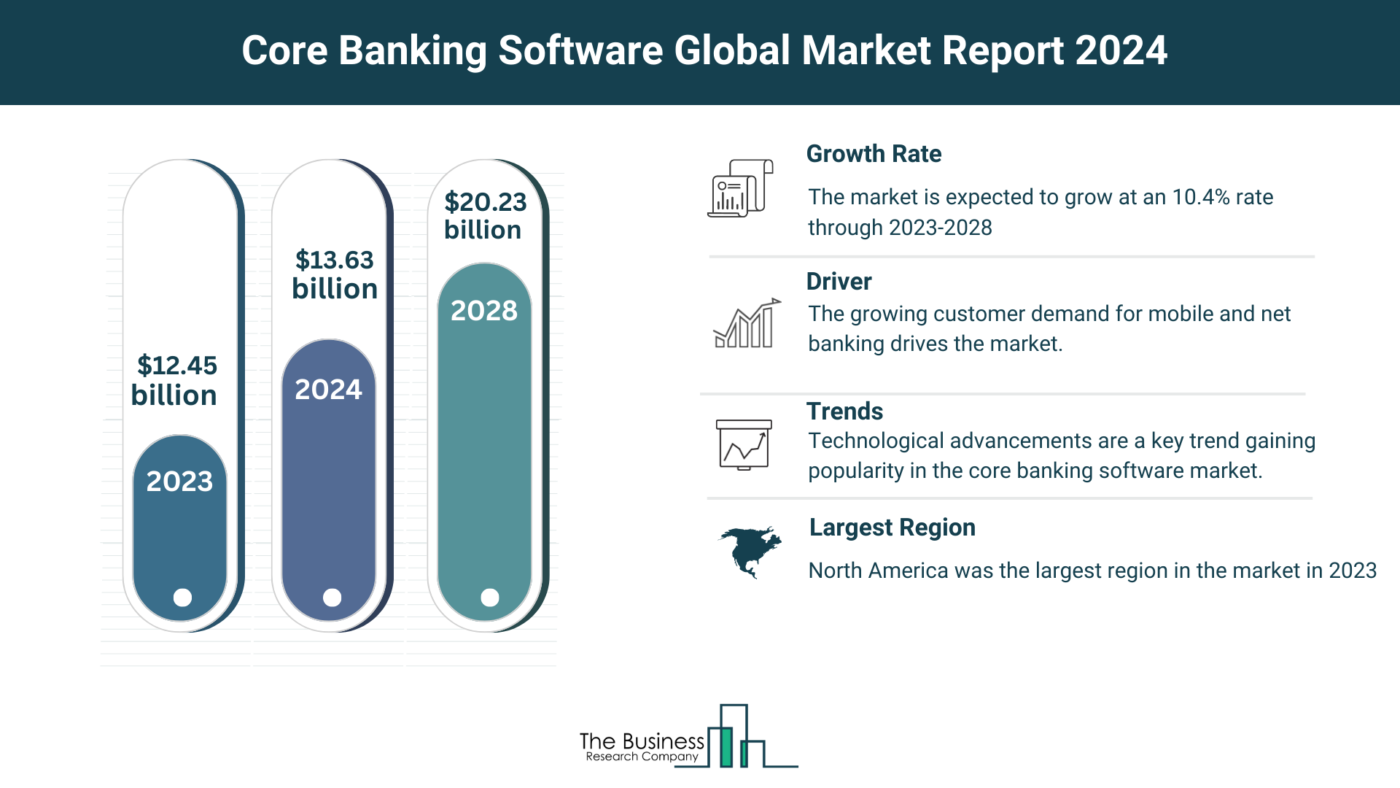

The core banking software market has experienced strong growth in recent years, with the market size expected to reach $13.63 billion in 2024, growing at a compound annual growth rate (CAGR) of 9.5%. This growth can be attributed to factors such as operational efficiency, customer experience, and the digital transformation of banking services. Looking ahead, the market is projected to continue its rapid growth, reaching $20.23 billion by 2028, with a CAGR of 10.4%.

Growing Customer Demand for Mobile and Net Banking

The growing customer demand for mobile and net banking is expected to drive the growth of the core banking software market. Mobile banking allows clients to use their mobile devices to access and manage their banking accounts, while net banking enables clients to conduct financial transactions online. The core banking software connects these services with the bank’s regular operating channels, ensuring smoother operations across all channels. With the global number of online banking users expected to reach 3.6 billion by 2024, the demand for core banking software to support mobile and net banking services is on the rise.

Read The Full Core Banking Software Market Report Here:

https://www.thebusinessresearchcompany.com/report/core-banking-software-global-market-report

Focus on Launch of New Technologies

Technological advancements are a key trend in the core banking software market, with major companies launching new technologies to enhance customer experience. For example, Temenos introduced the first AI-driven buy-now-pay-later banking service on the Temenos banking cloud, offering dependable loaning abilities to assist suppliers with adjusting to evolving regulations. These innovations are aimed at improving operational efficiency and providing customers with a seamless banking experience.

M2P Fintech Acquires BSG ITSOFT to Strengthen Banking Solutions

In a move to strengthen its banking solutions and payment stacks, M2P Fintech acquired BSG ITSOFT, a provider of core banking solutions. This acquisition highlights the growing demand for next-generation banking solutions and the importance of technology in the banking sector.

Market Segmentation and Regional Outlook

The core banking software market is segmented by service, solution, software deployment, and end use. Services include professional services and managed services, while solutions include deposits, loans, and enterprise customer solutions. The market serves various end users, including banks, financial institutions, and other end users. North America was the largest region in the core banking software market in 2023, with Asia Pacific expected to be the fastest-growing region in the forecast period.

Get A Free Sample On The Global Core Banking Software Market Report:

https://www.thebusinessresearchcompany.com/sample_request?id=7925&type=smp

The Core Banking Software Global Market Report 2024 provides an overview of the core banking software market for the time series: historic years (2010 – 2021) and ten years forecast (2023 – 2032). The core banking software market forecast analyzes core banking software market size, core banking software market share, leading competitor and their market positions.

The Table Of Content For The Core Banking Software Market Include:

1. Core Banking Software Market Executive Summary

2. Core Banking Software Market Segments

3. Core Banking Software Market Size And Core Banking Software Market Growth Rate

4. Key Core Banking Software Market Trends

5. Major Core Banking Software Market Drivers

……

25. Key Mergers And Acquisitions In The Core Banking Software Market

26. Top Core Banking Software Companies

27. Core Banking Software Market Opportunities And Strategies

28. Core Banking Software Market, Conclusions And Recommendations

29. Appendix

Explore Similar Reports From The Business Research Company:

Investment Banking Global Market Report 2024

Banking, Financial Services And Insurance (BFSI) Security Global Market Report 2024

Digital Banking Platform Global Market Report 2024

Learn More About The Business Research Company

The Business Research Company has published over 6500+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: