Insights Into The Wealth Management Market’s Growth Potential 2023-2032

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

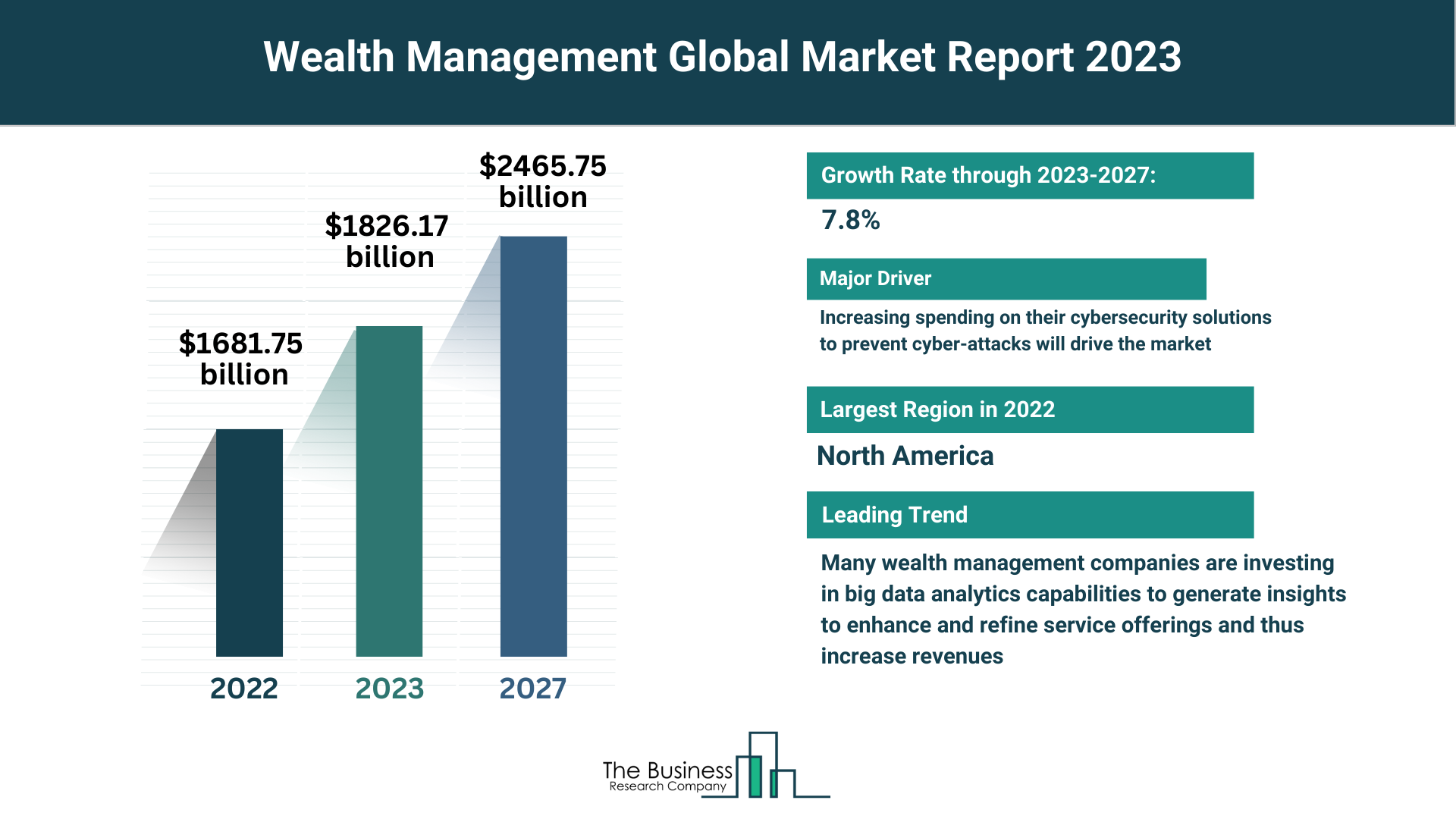

The global wealth management market has witnessed significant expansion, surging from $1681.75 billion in 2022 to $1826.17 billion in 2023, marking a robust compound annual growth rate (CAGR) of 8.6%. As the market anticipates reaching $2465.75 billion in 2027 with a CAGR of 7.8%, several trends are shaping the landscape, including increased cybersecurity measures and the integration of big data analytics.

- Fortifying Defenses: The Rise of Cybersecurity

- Wealth management firms are amplifying their cybersecurity investments to thwart potential cyber-attacks.

- Cybersecurity Significance:

- Protecting network integrity and sensitive client data.

- Strengthening security levels to prevent unauthorized access.

- Identifying and preventing theft and fraud in investment transactions.

- Industry Focus:

- 86% of financial services companies plan to increase spending on cybersecurity.

- Impact on Wealth Management:

- Safeguarding highly sensitive client information.

- Mitigating risks associated with cyber threats.

*2. Major Players: Pioneers in Wealth Management

- Leading the charge in the wealth management market are major companies with global influence.

- Key Industry Players:

- Industrial and Commercial Bank of China

- Legal & General Group plc

- CNP Assurances

- UBS

- Japan Post Group

- BlackRock

- JPMorgan Chase & Co.

- Morgan Stanley

- Citigroup

- Manulife Financial Corporation

- Industry Influence:

- Influential players steering the trajectory of the wealth management landscape.

- Strategic Investments: Big Data Analytics in Focus

- Wealth management companies are directing investments towards enhancing their big data analytics capabilities.

- Role of Big Data Analytics:

- Generating insights to refine and enhance service offerings.

- Assessing client segments, product penetration, and training program effectiveness.

- Analyzing client investment patterns, risk tolerance, and lifetime value.

- Real-world Application:

- CargoMetrics, a Boston-based investment firm, utilized Automatic Identification System (AIS) data for commodity movement analytics.

- Developed a platform for trading commodities, currencies, and equity index funds.

- The analytics tool was extended to other hedge funds and wealth managers.

- Business Impact:

- Enhanced business performance tracking.

- Increased client acquisition and retention rates.

- Real-time investment advice for clients.

- Market Segmentation: Unveiling Wealth Management Dynamics

- The wealth management market unfolds through a nuanced segmentation.

- Segmentation Breakdown:

- By Type:

- Funds, Trusts, and Other Financial Vehicles

- Asset Management

- Portfolio Management and Investment Advice

- By Advisory Mode:

- Human Advisory

- Robo Advisory

- Hybrid

- By Enterprise Size:

- Large Enterprises

- Medium and Small Enterprises

- By Type:

- Regional Dominance:

- North America emerges as the largest region in the wealth management market share in 2022.

- The region plays a pivotal role in steering global market dynamics.

Get A Free Sample On The Global Wealth Management Market Report:

https://www.thebusinessresearchcompany.com/sample_request?id=3577&type=smp

Read The Full Wealth Management Market Report Here:

https://www.thebusinessresearchcompany.com/report/wealth-management-global-market-report

The Wealth Management Global Market Report 2023 provides an overview of the wealth management market for the time series: historic years (2010 – 2021) and ten years forecast (2023 – 2032). The wealth management market forecast analyzes wealth management market size, wealth management market share, leading competitor and their market positions.

The Table Of Content For The Wealth Management Market Include:

1. Wealth Management Market Executive Summary

2. Wealth Management Market Segments

3. Wealth Management Market Size And Wealth Management Market Growth Rate

4. Key Wealth Management Market Trends

5. Major Wealth Management Market Drivers

……

25. Key Mergers And Acquisitions In The Wealth Management Market

26. Top Wealth Management Companies

27. Wealth Management Market Opportunities And Strategies

28. Wealth Management Market, Conclusions And Recommendations

29. Appendix

Explore Similar Reports From The Business Research Company:

Management Consulting Services Global Market Report 2023

Financial Analytics Market Report 2023

Financial Consulting Software Global Market Report 2023

Learn More About The Business Research Company

The Business Research Company has published over 6500+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: