5 Major Insights Into The Insurance, Reinsurance And Insurance Brokerage Market Report 2023

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

The Business Research Company’s Insurance, Reinsurance And Insurance Brokerage Global Market Report 2023 offers crucial insights into the insurance, reinsurance and insurance brokerage market help businesses analyse and build stronger strategies.

The global insurance, reinsurance, and insurance brokerage market are experiencing dynamic growth, driven by increasing market size and transformative trends. Let’s delve into the key factors propelling this growth and the evolving dynamics shaping the insurance industry.

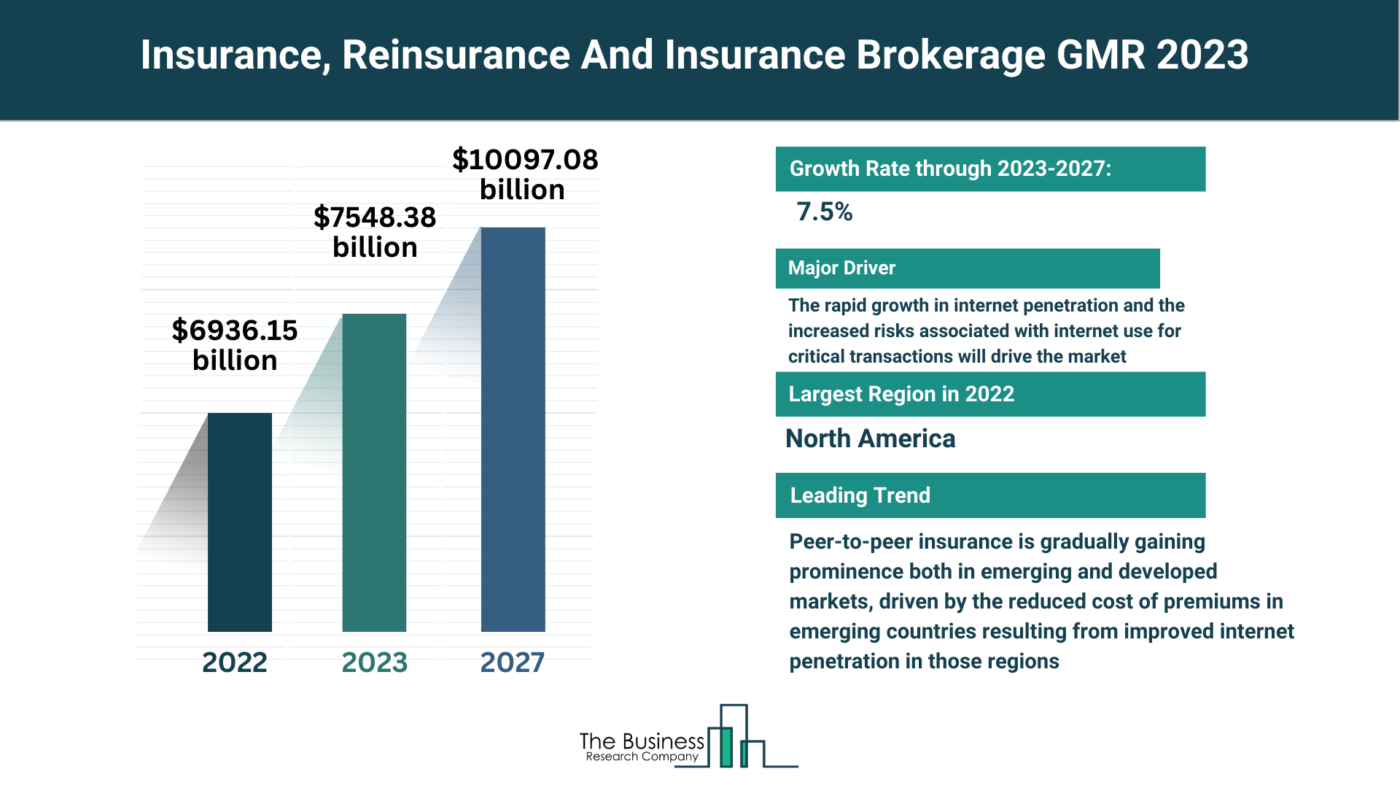

Market Growth and Projections

- Market Growth Projection:

- Grew from $6,936.15 billion (2022) to $7,548.38 billion (2023) at a CAGR of 8.8%.

- Expected market size of $10,097.08 billion in 2027 at a CAGR of 7.5%.

Rising Demand for Cyber Insurance

- Internet Penetration and Associated Risks:

- Rapid growth in internet penetration fuels the demand for cyber insurance.

- Cyber insurance covers risks related to internet-based transactions and IT infrastructure.

- Addresses property theft, business interruption, software and data loss, cyber extortion, and more.

- In 2021, India recorded 1.18 billion mobile connections, 600 million smartphones, and 700 million internet users.

- Increased internet use drives the need for comprehensive coverage against emerging risks.

Key Players in the Market

- Major Companies:

- Allianz Group, Ping An Insurance, Axa Group, Anthem Inc., China Life Insurance, and more.

- Industry giants contributing to the growth and competitiveness of the market.

Rise of Peer-to-Peer Insurance

- Emergence and Advantages:

- Peer-to-peer insurance gains prominence in emerging and developed markets.

- Driven by reduced premiums in emerging countries due to improved internet penetration.

- Based on pooling insurance premiums to compensate for future losses and share surplus among participants.

- Aims to decrease premium and overhead costs, enhance efficiency, and increase business transparency.

Market Segmentation for Diverse Solutions

- Segmentation Overview:

- Types: Insurance, Insurance Brokers and Agents, Reinsurance.

- Modes: Online, Offline.

- End Users: Corporate, Individual.

- Tailoring Solutions for Varied Needs:

- Diverse types cater to the multifaceted requirements of insurance and reinsurance.

- Modes of online and offline transactions provide flexibility for users.

- Distinct end-user categories address the unique needs of both corporate entities and individuals.

Regional Dominance: North America Leading the Way

- Regional Landscape:

- North America holds the largest market share in 2022.

- The region plays a pivotal role in shaping the global insurance, reinsurance, and insurance brokerage market.

Get A Free Sample On The Global Insurance, Reinsurance And Insurance Brokerage Market Report:

https://www.thebusinessresearchcompany.com/sample_request?id=3544&type=smp

Read The Full Insurance, Reinsurance And Insurance Brokerage Market Report Here:

https://www.thebusinessresearchcompany.com/report/insurance-reinsurance-and-insurance-brokerage-global-market-report

The Insurance, Reinsurance And Insurance Brokerage Global Market Report 2023 provides a comprehensive outlook of the insurance, reinsurance and insurance brokerage market for the historic years (2010 – 2021) and ten years forecast (2023 – 2032). The insurance, reinsurance and insurance brokerage market forecast offers a thorough analysis on insurance, reinsurance and insurance brokerage market size, insurance, reinsurance and insurance brokerage market share, prominent players and their strategies.

The Table Of Content For The Insurance, Reinsurance And Insurance Brokerage Market Include:

1. Insurance, Reinsurance And Insurance Brokerage Market Executive Summary

2. Insurance, Reinsurance And Insurance Brokerage Market Segments

3. Insurance, Reinsurance And Insurance Brokerage Market Size And Insurance, Reinsurance And Insurance Brokerage Market Growth Rate

4. Key Insurance, Reinsurance And Insurance Brokerage Market Trends

5. Major Insurance, Reinsurance And Insurance Brokerage Market Drivers

……

25. Key Mergers And Acquisitions In The Insurance, Reinsurance And Insurance Brokerage Market

26. Top Insurance, Reinsurance And Insurance Brokerage Companies

27. Insurance, Reinsurance And Insurance Brokerage Market Opportunities And Strategies

28. Insurance, Reinsurance And Insurance Brokerage Market, Conclusions And Recommendations

29. Appendix

Explore Similar Reports From The Business Research Company:

Insurance Brokers & Agents Global Market Report 2023

Insurance Fraud Detection Global Market Report 2023

Insurance Global Market Report 2023

Learn More About The Business Research Company

The Business Research Company has published over 6500+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: