Estimated Growth Potential Of The Lending Market 2023-2032

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

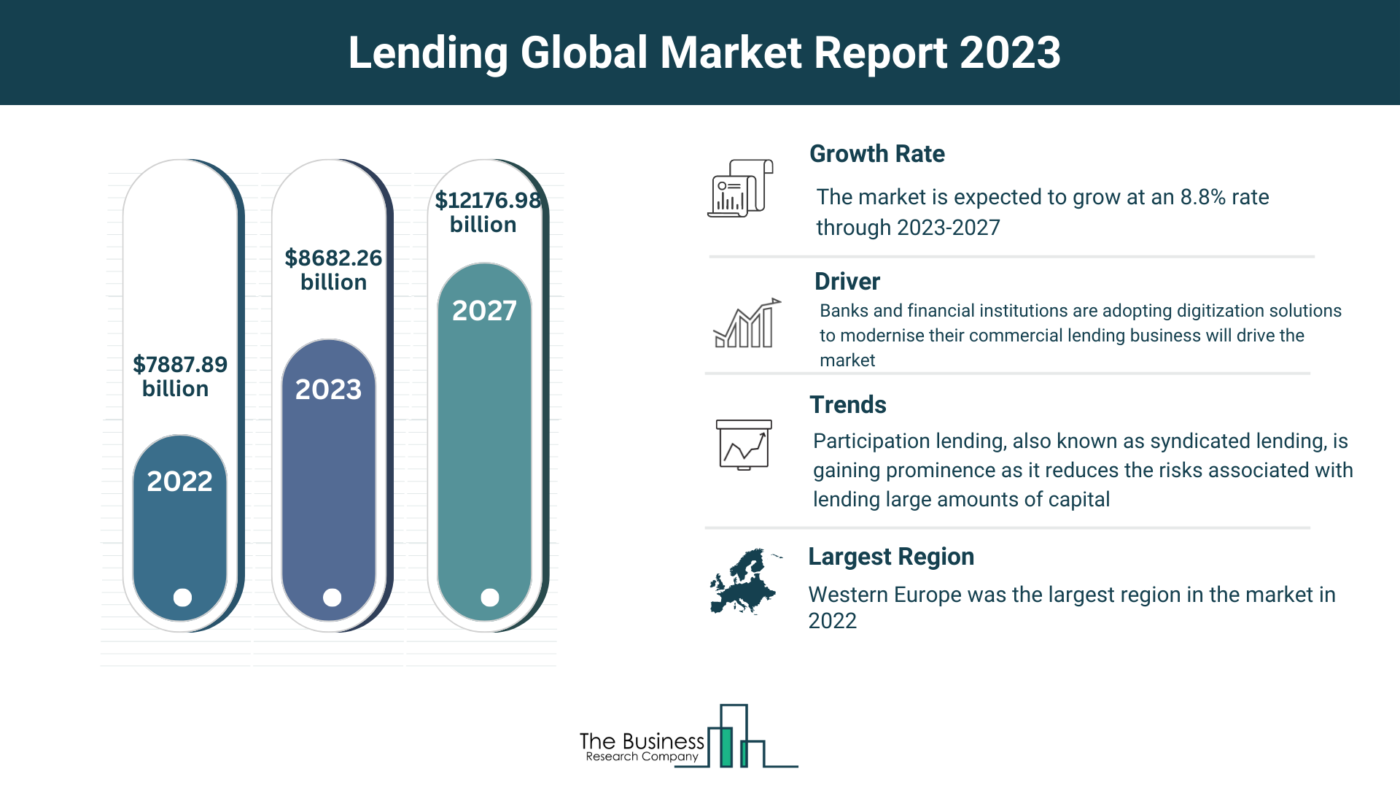

As per The Business Research Company’s “Lending Global Market Report 2023,” the global lending market is projected to rise from $7,887.89 billion in 2022 to $8,682.26 billion in 2023, with a 10.1% CAGR. By 2027, the market is anticipated to reach $12,176.98 billion, growing at an 8.8% CAGR.

Western Europe held the largest lending market share.

Lending Market Driver

Banks and financial institutions use digital solutions to modernize commercial lending due to higher competition and the demand for quicker processes. Digitization speeds up loan approvals and facilitates targeting new customer segments, enhancing commercial lending efficiency. Leading adopters include Commonwealth Bank of Australia, Hana Bank, and Fidor Bank.

View More On The Lending Market Report 2023 –

https://www.thebusinessresearchcompany.com/report/lending-global-market-report

Key Lending Market Segments

The global lending market is segmented –

1) By Type: Corporate Lending, Household Lending, Government Lending

2) By Interest Rate: Fixed Rate, Floating Rate

3) By Lending Channel: Offline, Online

Lending Market Prominent Players

Major companies in the lending market include China Construction Bank, Agricultural Bank of China, JPMorgan Chase & Co., Bank of China, Industrial and Commercial Bank of China, Citigroup, Bank of America Corporation, State Bank of India, Mitsubishi UFJ Financial Group, and Legal & General Group plc.

Request A Sample Of The Global Lending Market Report 2023:

https://www.thebusinessresearchcompany.com/sample_request?id=3575&type=smp

Prominent Lending Market Trend

Participation lending, or syndicated lending, gains prominence due to risk reduction in large capital lending. It involves multiple lenders providing a loan to a single borrower, typically with one financial institution originating and another administering it. This method’s popularity grows, enabling diverse loan products and enhancing business liquidity. The partnership widens business lending for financial institutions, sharing funding and risk, eliminating manual tracking, and optimizing lending procedures. Companies engaged in participation lending include Coastway Community Bank, Shamrock Financial Corp., and Homestar Mortgage.

The Lending Global Market Report 2023 provides comprehensive insights on the lending market size, trends and drivers, opportunities, strategies, and competitor analysis. The countries covered in the lending market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Lending And Payments Global Market Report 2023

Insurance Brokers & Agents Global Market Report 2023

Insurance, Reinsurance And Insurance Brokerage Global Market Report 2023

Learn More About The Business Research Company

The Business Research Company has published over 3000+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model