5 Key Takeaways From The Guaranteed Auto Protection (GAP) Insurance Market Report 2023

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

As per The Business Research Company’s Guaranteed Auto Protection (GAP) Insurance Global Market Report 2023, the guaranteed auto protection (GAP) insurance market is expected to show significant growth in the forecast period.

Key insights from the guaranteed auto protection (GAP) insurance market forecast include:

- Market Size

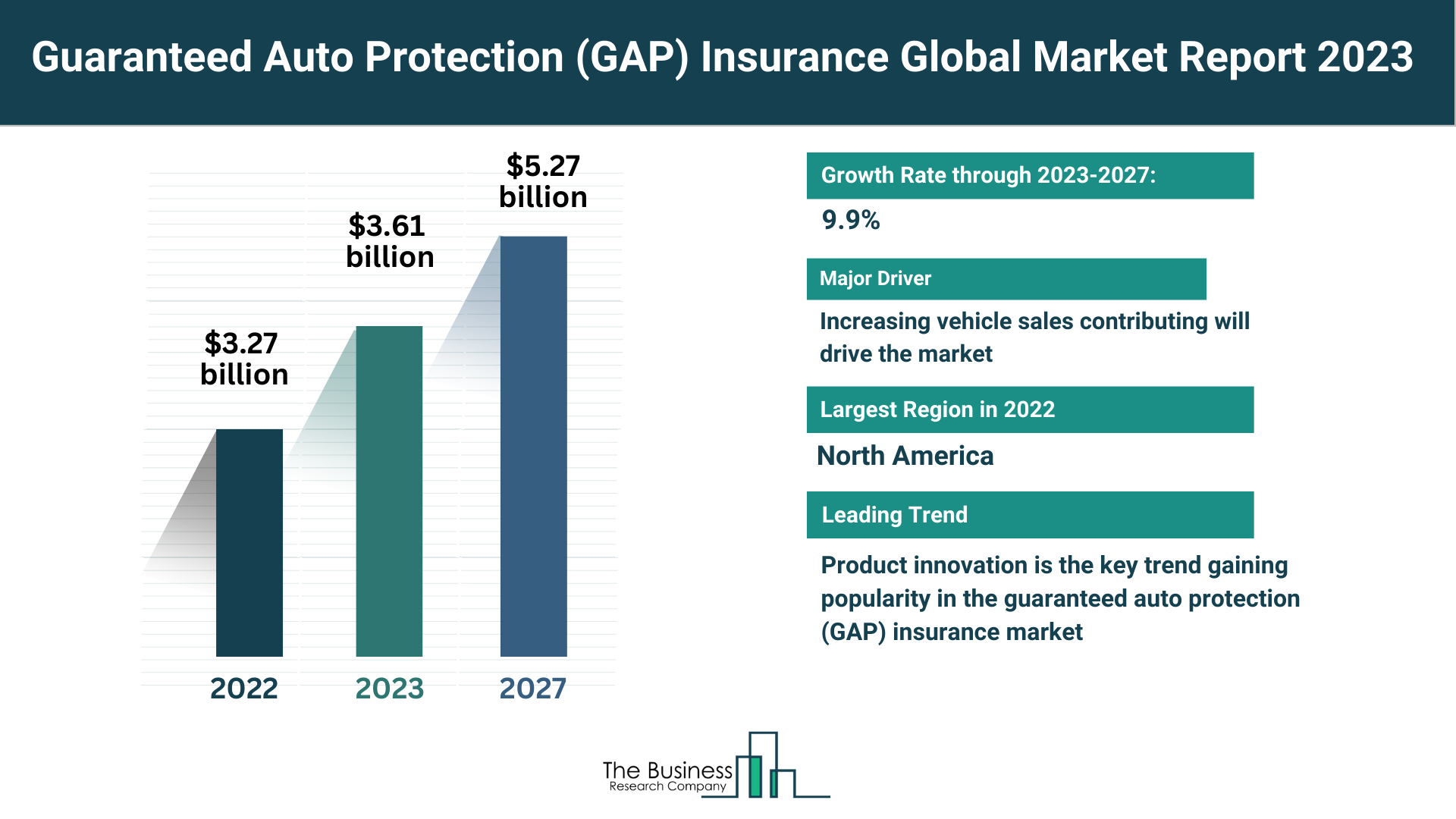

The global guaranteed auto protection (GAP) insurance market is projected to expand from $3.27 billion in 2022 to $3.61 billion in 2023, with a 10.4% compound annual growth rate (CAGR). The Russia-Ukraine conflict has hampered the global economic recovery following the COVID-19 pandemic. The war resulted in economic sanctions, rising commodity prices, supply chain disruptions, and impacts on various global markets. The GAP insurance market is anticipated to reach $5.27 billion in 2027, growing at a CAGR of 9.9%.

- Major Driver

Growing vehicle sales significantly drive the expansion of the guaranteed auto protection (GAP) insurance market. Factors such as increased demand for transportation, vehicles as a lifestyle choice, rising incomes, and more contribute to the surge in vehicle sales. GAP insurance covers the discrepancy between a vehicle’s current value (covered by regular insurance) and the amount owed in case of severe damage or total loss in an accident. For example, in June 2023, the Society of Motor Manufacturers and Traders (SMMT) reports an anticipated 25.8% increase in UK passenger car sales, from 140,958 units in 2022 to 177,266 units in 2023. Moreover, according to the International Organization of Motor Vehicle Manufacturers, global passenger vehicle sales rose from 56.43 million in 2021 to 57.48 million in 2022. Hence, surging vehicle sales fuel the guaranteed auto protection (GAP) insurance market’s growth.

View More On The Guaranteed Auto Protection (GAP) Insurance Market Report 2023 – https://www.thebusinessresearchcompany.com/report/guaranteed-auto-protection-gap-insurance-global-market-report

- Key Trend

In the guaranteed auto protection (GAP) insurance market, product innovation is a prominent trend. Key companies are creating inventive auto insurance products and services for vehicles to maintain their market position. For example, in April 2021, AXA Affin General Insurance, a Malaysia-based insurance company, introduced Guaranteed Asset Protection – Return to Insured Value (GAP-RTIV), a plan that safeguards a car’s full value in case of a total loss. This offering enhances the company’s portfolio, aiming to protect car owners from unexpected financial burdens associated with covering the uninsured residual value of the vehicle. It is available for cars up to five years old, with a one-time upfront payment. Once the comprehensive vehicle insurance claim is settled, and the necessary documentation is provided by the owner, the company will promptly process the GAP-RTIV claim.

- Major Players

Major players in the guaranteed auto protection (gap) insurance market are Berkshire Hathaway Inc., Axa S.A., State Farm Mutual Automobile Insurance Company, Nationwide Mutual Insurance Company, Allstate Insurance Company, Liberty Mutual Insurance Company, Progressive Casualty Insurance Company, Zurich Insurance Group Ltd., Chubb Limited, The Travelers Indemnity Company, Government Employees Insurance Company, The Hartford Financial Services Group Inc., American Family Insurance, Allianz SE, Auto-Owners Insurance Group, Arch Insurance Group Inc., Kemper Corporation, Amica Mutual Insurance Company, Erie Insurance, Infinity Auto Insurance, Admiral Group plc, Esurance Insurance Services Inc., American Automobile Association Inc., Assurity Solutions, and Motor Gap Limited.

- Top Market Segments

The global guaranteed auto protection (GAP) insurance market is segmented –

1) By Type: Return-To-Invoice GAP Insurance, Finance GAP Insurance, Vehicle Replacement GAP Insurance, Return-To-Value GAP Insurance, Other Types

2) By Distribution Channel: Agents And Brokers, Direct Response, Other Distribution Channels

3) By Application: Passenger Vehicle, Commercial Vehicle

4) By End-User: Individuals, Corporates

Request A Sample Of The Global Guaranteed Auto Protection (GAP) Insurance Market Report 2023:

https://www.thebusinessresearchcompany.com/sample_request?id=12640&type=smp

The Guaranteed Auto Protection (GAP) Insurance Global Market Report 2023 provides an in-depth analysis on the guaranteed auto protection (GAP) insurance market size, trends and drivers, opportunities, strategies, and companies analysis. The countries covered in the guaranteed auto protection (GAP) insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Active Protection Systems Global Market Report 2023

DDoS Protection And Mitigation Global Market Report 2023

Insurance Global Market Report 2023

Learn More About The Business Research Company

The Business Research Company has published over 3000+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model