Understand How The GCC Bancassurance Market Is Set To Grow In Through 2023-2032 – Includes GCC Bancassurance Market Overview

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

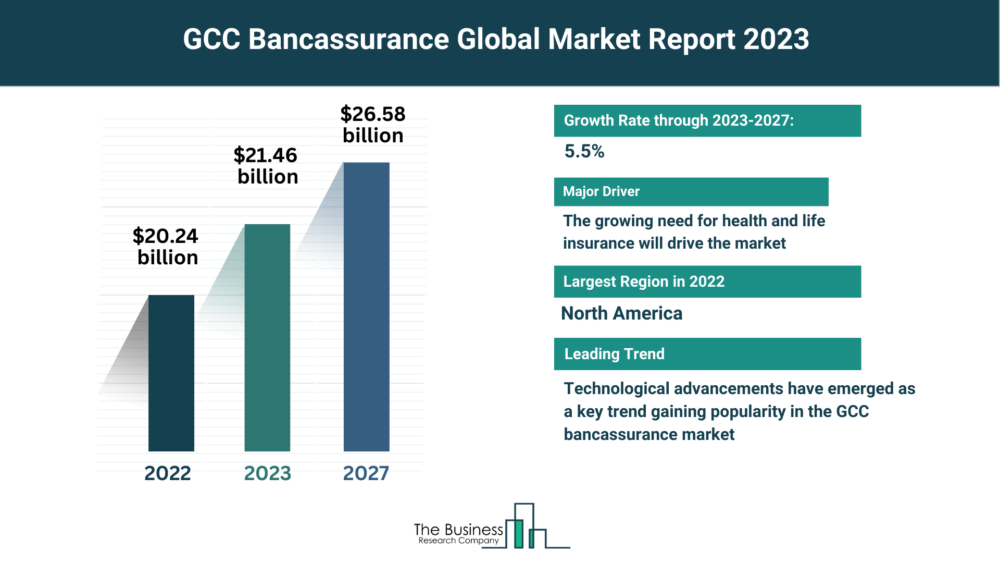

The global GCC bancassurance market is on the rise, with a projected growth from $20.24 billion in 2022 to $21.46 billion in 2023, reflecting a compound annual growth rate (CAGR) of 6.0%. Looking ahead, the market is poised to reach $26.58 billion in 2027, boasting a CAGR of 5.5%. This upward trajectory can be attributed to the increasing demand for health and life insurance, crucial elements in protecting individuals and their families.

- Life Insurance’s Protective Shield:Life insurance plays a pivotal role in providing financial security to beneficiaries in the event of the insured person’s injury or demise.

- Health Insurance’s Preventive Role:Acting as a shield against financial hardship, health insurance safeguards individuals and families from adverse outcomes, such as fatalities.

- GCC Bancassurance:An Enabling Strategy: This market leverages the collaboration between banks and insurers, offering a distribution channel that allows banks to provide insurance products. The Organization for Economic Co-operation and Development (OECD) report of June 2021 highlighted a 7.3% average increase in life sector claims payments across 53 reporting countries, emphasizing the industry’s responsiveness to evolving needs, influenced by factors like the COVID-19 pandemic.

Industry Landscape: Key Players Shaping the Market

Major players in the GCC bancassurance market are instrumental in steering its growth. These entities, including Gulf Insurance Group, MANAFA Capital, and others, contribute to the market’s vitality and resilience.

- Noteworthy Entities:Gulf Insurance Group (GIG), MANAFA Capital, Startupbootcamp FinTech, Bahrain Kuwait Insurance Co., and others play pivotal roles in shaping the market.

Tech-Infused Evolution: Technological Advancements in GCC Bancassurance

In a rapidly evolving landscape, technological advancements have emerged as a defining trend in the GCC bancassurance market. Major companies are integrating cutting-edge technologies to automate operations and fortify their market positions.

- Mashreq Bank’s Innovative Leap:In November 2021, Mashreq Bank, a UAE-based institution, introduced the ASSURE Banca Platform. This initiative, developed in collaboration with WayPoint System, exemplifies the market’s push towards automation. The platform streamlines bancassurance operations, enhancing user experience and offering benefits such as cost reduction and sophisticated client management.

- Advantages of ASSURE Banca Platform:This platform delivers a valuable and personalized user experience, lowers operating costs, and facilitates connections with external insurance companies through API-driven technology. Stakeholders benefit from efficient insurance distribution, commission management, and customer service.

Market Segmentation: Unveiling the Diversity

The global GCC bancassurance market is intricately segmented, allowing for a nuanced understanding of its dynamics.

- By Product Type:

- Life Bancassurance:Catering to the financial protection needs of individuals and their families.

- Non-Life Bancassurance:Offering coverage beyond life scenarios, addressing various risk factors.

- By Model Type:

- Pure Distributor:Emphasizing distribution channels without exclusive partnerships.

- Exclusive Partnership:Fostering collaboration for exclusive offerings.

- Financial Holding:Integrating financial entities for comprehensive services.

- Joint Venture:Collaborative efforts for a mutually beneficial market presence.

Get A Free Sample On The Global GCC Bancassurance Market Report:

https://www.thebusinessresearchcompany.com/sample_request?id=8971&type=smp

Read The Full GCC Bancassurance Market Report Here:

https://www.thebusinessresearchcompany.com/report/gcc-bancassurance-global-market-report

The GCC Bancassurance Global Market Report 2023 provides an overview of the GCC bancassurance market for the time series: historic years (2010 – 2021) and ten years forecast (2023 – 2032). The GCC bancassurance market forecast analyzes GCC bancassurance market size, GCC bancassurance market share, leading competitor and their market positions.

Explore Similar Reports From The Business Research Company:

Insurance, Reinsurance And Insurance Brokerage Global Market Report 2023

Insurance Global Market Report 2023

Insurance Analytics Global Market Report 2023

Learn More About The Business Research Company

The Business Research Company has published over 6500+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model