5 Key Takeaways From The Family Floater Health Insurance Market Report 2023

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

As per The Business Research Company’s Family Floater Health Insurance Global Market Report 2023, the family floater health insurance market is expected to show significant growth in the forecast period.

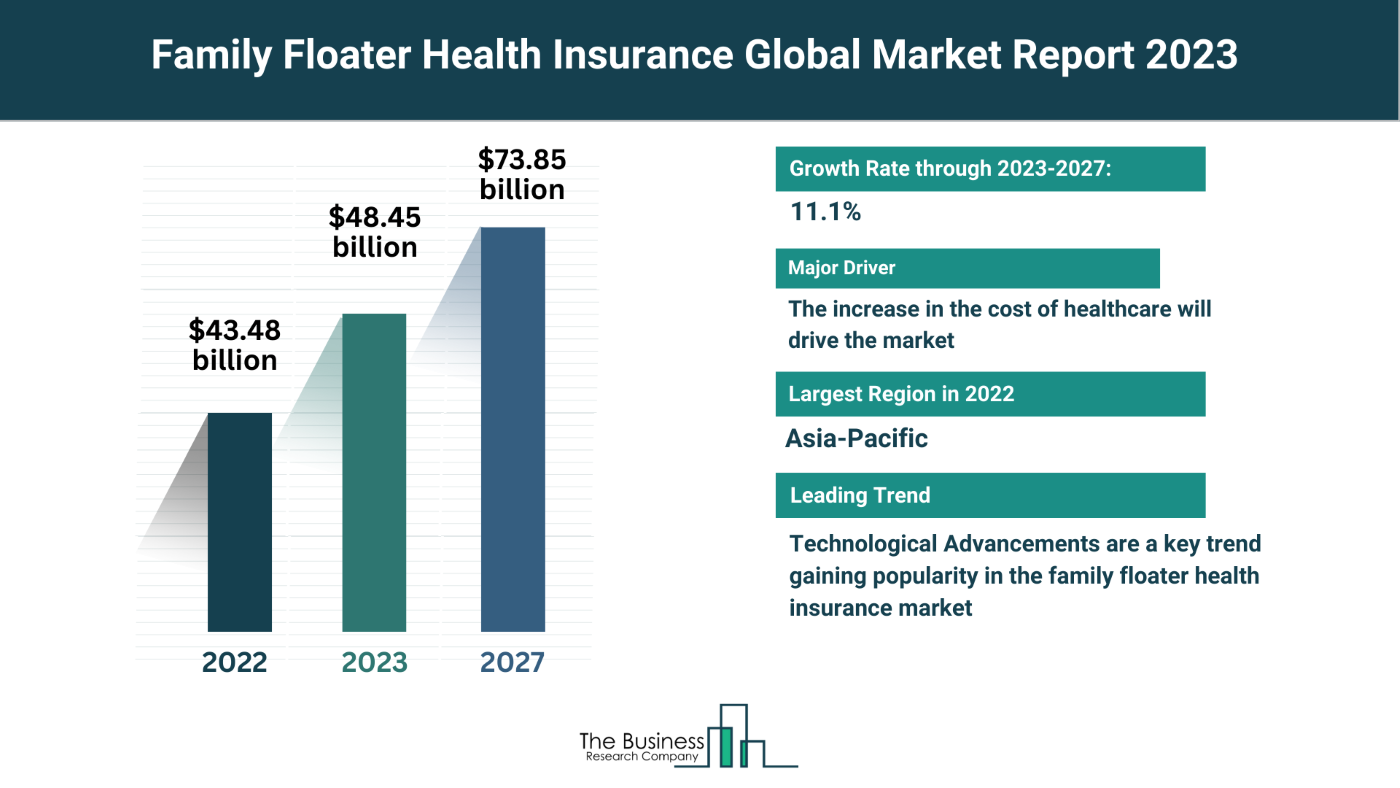

The global family floater health insurance market is on a growth trajectory, set to expand from $43.48 billion in 2022 to $48.45 billion in 2023, marked by a substantial compound annual growth rate (CAGR) of 11.4%. Further, the market is projected to reach $73.85 billion by 2027, sustaining a CAGR of 11.1%. In this blog, we’ll explore the driving factors behind this growth, delve into the prominent industry players, and discuss the emergence of technological advancements in family floater health insurance.

Securing Lives: The Escalating Cost of Healthcare

The family floater health insurance market’s accelerated growth is underpinned by the increasing cost of healthcare. Rising healthcare costs encompass the expenses incurred by individuals, organizations, and societies in the delivery of healthcare goods and services aimed at preserving or restoring health. Family floater health insurance offers diverse coverage options, tailored by specific insurance providers, to protect entire families in the event of a family member’s demise and provide financial support to an ailing family member requiring treatment. For example, in August 2022, Willis Towers Watson PLC conducted a “2022 Best Practices in Healthcare” survey among 455 U.S. employers, revealing that healthcare costs for these employers were projected to rise by 6.0% in the following year, exceeding the 5.0% average increase observed in 2022. Thus, the surge in healthcare costs is a driving force behind the flourishing family floater health insurance market.

Key Players in the Market

The family floater health insurance market is significantly influenced by major industry players, who actively shape its growth and development. Key market players include:

- UnitedHealth Group

- Aetna Inc.

- CVS Health

- Cigna Healthcare

- Allianz SE

- Axa S.A.

- Kaiser Foundation Health Plan Inc.

- Humana Inc

- MetLife Services and Solutions LLC

- Liberty Mutual Insurance

- Apollo Munich Insurance Company Limited

- HBF Health Ltd.

These influential entities drive the industry’s growth through product innovation and technological advancements.

Pioneering Technology: A Growing Trend

One noteworthy trend in the family floater health insurance market is the integration of innovative technology. Major companies in the industry are adopting cutting-edge technology to sustain their positions and meet evolving consumer needs. For instance, in April 2023, Plum Benefits Private Limited, an India-based health insurance company, launched the AI-powered tool PolicyGPT. PolicyGPT is a chatbot developed using Open AI’s GPT-3 architecture, designed to provide individuals with information about their health insurance policies from Plum. It possesses access to users’ policy details and a comprehensive understanding of health insurance concepts, with the primary purpose of informing users about their coverage. This represents a leap forward in the utilization of artificial intelligence to improve the customer experience in the family floater health insurance market.

Varied Coverage Options to Meet Diverse Needs

The family floater health insurance market offers diverse coverage options to cater to the wide-ranging needs of individuals and families:

- By Coverage:

- In-Patient Hospitalization

- Pre and Post Hospitalization Cost

- Day Care Treatments

- Other Coverages

- By Plan Type:

- Immediate Family Plan

- Extended Family Plan

- By Distribution Channel:

- Insurance Companies

- Banks

- Agents and Brokers

- Other Distribution Channels

Global and Regional Dynamics

In 2022, Asia-Pacific took the lead in the family floater health insurance market, illustrating its pivotal role in this industry. While facing challenges, the market remains dynamic and adaptable, with regions worldwide set to contribute to its continued growth.

View More On The Family Floater Health Insurance Market Report 2023 – https://www.thebusinessresearchcompany.com/report/family-floater-health-insurance-global-market-report

Request A Sample Of The Global Family Floater Health Insurance Market Report 2023:

https://www.thebusinessresearchcompany.com/sample_request?id=12368&type=smp

The Family Floater Health Insurance Global Market Report 2023 provides an in-depth analysis on the family floater health insurance market size, trends and drivers, opportunities, strategies, and companies analysis. The countries covered in the family floater health insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Life And Health Reinsurance Global Market Report 2023

Insurance Global Market Report 2023

Individual And Family Services Global Market Report 2023

Learn More About The Business Research Company

The Business Research Company has published over 3000+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model