Projected Growth Potential of the InsurTech Insurance Technology Market from 2023 to 2032

The latest updates to global market reports from The Business Research Company now include the most current market sizing data for 2023, extending forecasts up to 2032.

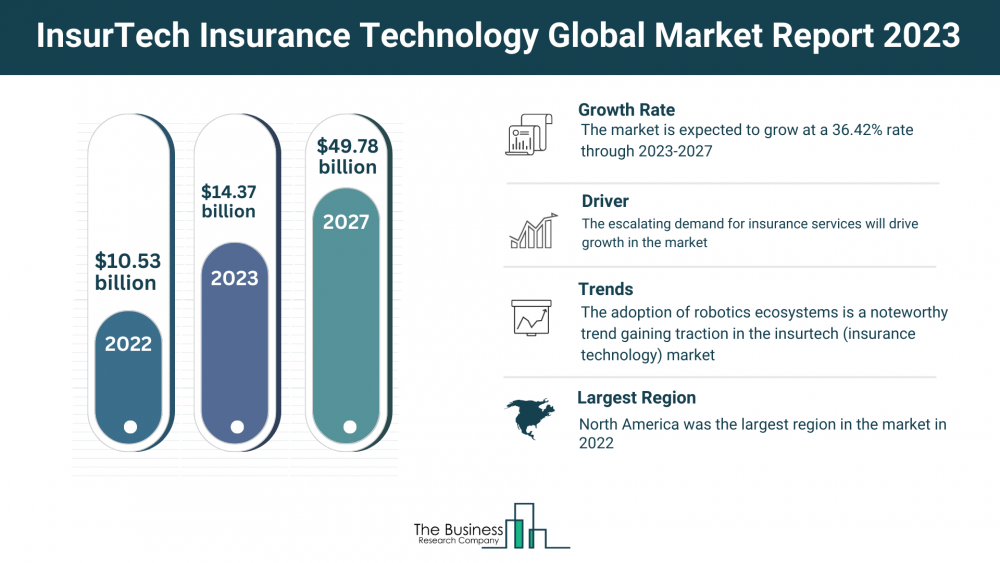

According to The Business Research Company’s InsurTech Insurance Technology Global Market Report 2023, the anticipated growth of the global insurTech (insurance technology) market is substantial. The market size is projected to expand from $10.53 billion in 2022 to $14.37 billion in 2023, with a compound annual growth rate (CAGR) of 36.52%. By 2027, the market size is expected to further increase to $49.78 billion, with a CAGR of 36.42%.

In 2022, North America dominated the insurTech insurance technology market share, while Asia-Pacific emerged as the fastest-growing region.

Driver of the InsurTech Insurance Technology Market:

The escalating demand for insurance services is poised to drive the expansion of the insurtech (insurance technology) market. Insurance acts as a protective contract between individuals or entities (the insured) and insurance companies (insurers), offering financial loss coverage. Increasingly, insurance companies are embracing insurance technology, known as insurtech, to enhance operations, elevate customer experiences, and boost efficiency. For example, in 2021, according to the Centers for Medicare & Medicaid Services (CMS), spending on private health insurance in the US increased by 5.8%, totaling $1,211.4 billion, constituting about 28% of the total national health expenditure (NHE). Furthermore, in 2021, 91.1% of people were covered by health insurance, and this figure is projected to reach 90.5% by 2030. Consequently, the surge in insurance demand is a prime factor driving the growth of the insurtech (insurance technology) market.

View More On The InsurTech Insurance Technology Market Report 2023 – https://www.thebusinessresearchcompany.com/report/insurtech-insurance-technology-global-market-report

Key InsurTech Insurance Technology Market Segments

1) By Offering: Solution, Service

2) By Insurance Type: Commercial Insurance, Property And Casualty Insurance, Health Insurance, Life Insurance, Other Insurance Types

3) By Deployment Model: On-Premise, Cloud

4) By Technology: Cloud Computing, Blockchain, Big Data And Analytics, Artificial Intelligence, Internet Of Things (IoT), Machine Learning, Other Technologies

5) By End-Use: Banking, Financial Services, And Insurance (BFSI), Healthcare, Manufacturing, Government, Retail, Other End Users

Major Players in the InsurTech Insurance Technology Market:

Prominent players in the insurtech (insurance technology) market include Damco Group, DXC Technology Company, Shift Technology, Wipro Limited, Oscar Insurance Corporation, Quantemplate, Zhongan Insurance Company, Trov Insurance Solutions LLC, Clover Health Insurance, Insurance Technology Services, EIS Group, Acko General Insurance Company, Policy Bazaar, Simplesurance GmbH, and Amodo.

Request A Sample Of The Global InsurTech Insurance Technology Market Report 2023:

https://www.thebusinessresearchcompany.com/sample.aspx?id=10740&type=smp

Notable Trend in the InsurTech Insurance Technology Market

The adoption of robotics ecosystems is a noteworthy trend gaining traction in the insurtech (insurance technology) market. Companies within the insurtech market are incorporating robotic technologies to maintain their competitive edge. For example, in September 2022, Koop Technologies, a US-based insurance technology company, introduced robotic errors and omissions insurance, designed exclusively for the insurtech market to address automation-related risks. This coverage targets manufacturers, operators, and service providers of robots and off-road autonomous vehicles across diverse industries. It employs a distinctive risk assessment process, generating customized ratings based on specific software and hardware attributes. Tailored to the distinct demands of the robotics environment, this policy takes into account technological and safety engineering characteristics. The coverage focuses on off-road robots, particularly the “automation as a class” risk category, transitioning from software-defined exposure to human-centric exposure in real-world operational domains.

The InsurTech Insurance Technology Global Market Report 2023 furnishes comprehensive insights into the insurTech insurance technology market’s size, trends and drivers, opportunities, strategies, and competitor analysis. Covered countries include Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA. The major seven regions encompass Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Insurance Agencies Global Market Report 2023

Insurance Brokers & Agents Global Market Report 2023

Insurance (Providers, Brokers And Re-Insurers) Global Market Report 2023

Learn More About The Business Research Company

The Business Research Company has published over 3000+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model