Global Insurance, Reinsurance And Insurance Brokerage Market Size, Forecasts, And Opportunities

Learn about the global insurance, reinsurance and insurance brokerage market through The Business Research Company, which provides information on insurance, reinsurance and insurance brokerage market size, insurance, reinsurance and insurance brokerage market drivers and restraints, insurance, reinsurance and insurance brokerage market players, the COVID-19 impact on the insurance, reinsurance and insurance brokerage market, and more.

The global insurance, reinsurance and insurance brokerage market size is expected to grow from $6,254.86 billion in 2021 to $6,905.65 billion in 2022 at a compound annual growth rate (CAGR) of 10.4%. The global insurance, reinsurance, brokerage market size is then expected to grow to $9,762.37 billion in 2026 at a CAGR of 9%.

The rapid growth in internet penetration and increased risks associated with internet use for critical transactions is driving the demand for cyber insurance.

Request A Sample For The Global Insurance, Reinsurance And Insurance Brokerage Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3544&type=smp

The insurance, reinsurance, and insurance brokerage market consists of sales of insurance by entities (organizations, sole traders, and partnerships) that are engaged in providing insurance and related activities such as underwriting (assuming the risk and assigning premiums) policies, insurance brokerage, and reinsurance. The insurance industry is categorized based on the business model of the firms present in the industry. Some insurance firms may offer other services financial or otherwise. Contributions and premiums are set based on actuarial calculations of probable payouts based on risk factors from experience tables and expected investment returns on reserves. The value of the market is based on the premiums paid by those insured, both commercial and personal as well as the fees or commissions paid to brokers.

Global Insurance, Reinsurance And Insurance Brokerage Market Segments Include:

By Type: Insurance, Insurance Brokers and Agents, Reinsurance

By Mode: Online, Offline

By End-User: Corporate, Individual

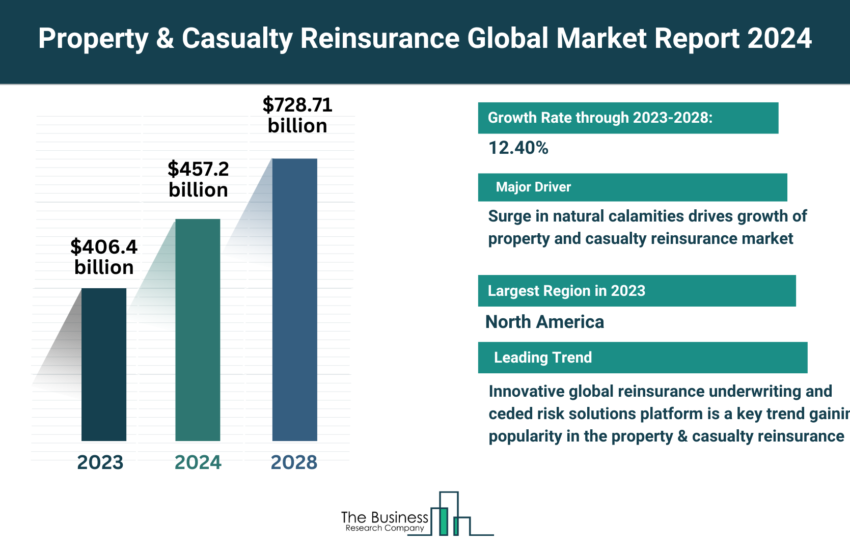

Subsegments Covered: Life Insurance, Property and Casualty Insurance, Health and Medical Insurance, Insurance Agencies, Insurance Brokers, Bancassurance, Other Intermediaries, Property and Casualty Reinsurance, Life and Health Reinsurance

By Geography: The market is segmented into North America, South America, Asia-Pacific, Eastern Europe, Western Europe, Middle East and Africa. Among these regions, North America was the largest region in the global insurance, reinsurance, and insurance brokerage market in 2021

Peer-to-peer insurance is gradually gaining prominence both in emerging and developed markets driven by the reduced cost of premium in emerging countries resulting from improved internet penetration in those regions. Peer-to-peer insurance is based on pooling insurance premiums of participating individuals that can be used to compensate future uncertain losses and share the left-over amount among participants. It aims to reduce premium and overhead costs than traditional Insurance Providers, decrease inefficiencies, and increase the transparency of businesses.

TBRC’s insurance, reinsurance and insurance brokerage market report covers:

Major Market Players: Allianz Group, Ping An Insurance, Axa Group, Anthem Inc., China Life Insurance, Centene, People’s Insurance Company of China, Humana, Assicurazioni Generali S.p.A., and Japan Post Group.

Regions: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

Countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

Time Series: Five years historic (2016-21) and ten years forecast (2022-2026-2031)

The Insurance, Reinsurance And Insurance Brokerage Global Market Report 2022– Market Size, Trends, And Global Forecast 2022-2026 is one of a series of new reports from The Business Research Company that provides insurance, reinsurance and insurance brokerage market overviews, analyzes and forecasts market size, share, insurance, reinsurance and insurance brokerage market players, insurance, reinsurance and insurance brokerage market segments and geographies, leading competitor revenues, profiles and market shares.

TBRC’s insurance, reinsurance and insurance brokerage market report identifies top countries and segments for opportunities and strategies based on market trends and leading competitors’ approaches.

Here Is A List Of Similar Reports From The Business Research Company:

Insurance Brokers Market Report 2022

Insurance Agencies Market Report 2022

Reinsurance Global Market Report 2022

Interested To Know More About The Business Research Company?

The Business Research Company has published over 1000 industry reports, covering over 2500 market segments and 60 geographies. The reports draw on 150,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. The reports are updated with a detailed analysis of the impact of COVID-19 on various markets.

Read more about us at https://www.thebusinessresearchcompany.com/about-the-business-research-company.aspx

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow us on LinkedIn: https://in.linkedin.com/company/the-business-research-company

Follow us on Twitter: https://twitter.com/tbrc_infao

Check out our Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: