Global Tax Preparation Services Market Overview: Trends Shaping Growth to 2029

Unlock Global Insights – Save 20% on Market Reports with Code ONLINE20

What Market Value Is The Tax Preparation Services Industry Expected To Reach By 2029, Starting From 2025 Levels?

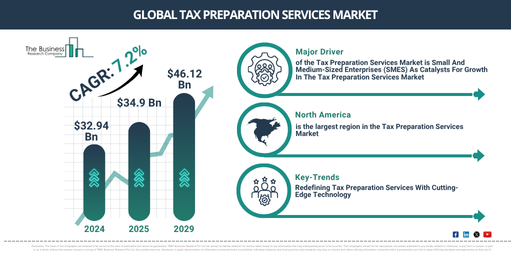

The tax preparation services market size has experienced significant expansion in recent years. Its valuation is set to increase from $32.94 billion in 2024 to $34.9 billion in 2025, reflecting a compound annual growth rate (CAGR) of 6.0%. This historical growth can be linked to traditional tax filing methods, complex tax regulations, shifts in tax legislation, the proliferation of small businesses, and enhanced consumer awareness and education.

The tax preparation services market is anticipated to experience substantial growth in the upcoming years. Its size is projected to reach $46.12 billion by 2029, exhibiting a compound annual growth rate (CAGR) of 7.2%. This expansion during the forecast period is attributable to several factors, including enhancements in tax software, the rise of remote work and virtual services, increased regulatory focus on digital reporting, shifts in the economy and stimulus initiatives, and the availability of personalized tax planning services. Key trends expected during this period encompass a greater emphasis on educating customers, the broadening of do-it-yourself (DIY) tax software options, the utilization of data analytics for generating insights, the availability of mobile tax filing services, and increasing consideration of environmental, social, and governance (ESG) factors.

Unlock Your Free Sample Report for Exclusive Market Data:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9597&type=smp

Which Factors And Drivers Are Influencing The Tax Preparation Services Market In 2025?

The growing number of small and medium-sized enterprises is anticipated to propel the expansion of the tax preparation services market in the future. These are privately owned businesses characterized by capital, workforce, and assets that fall below specific national guidelines. Tax preparation services are frequently leveraged by small and medium-sized businesses to manage their goods and services tax payments. Governments recognize the crucial role of small and medium-sized enterprises (SMEs) in the economy and regularly provide incentives, such as favorable tax treatment and easier access to loans, to ensure their sustainability, which in turn stimulates the growth of the tax preparation services market. For instance, in May 2022, a report from the US Small Business Administration, a US-based government agency, showed that the US had 31.7 million small businesses and 20,139 large businesses. Over the past two decades, small businesses in the US generated 10.5 million net new jobs, compared to 5.6 million jobs added by large businesses. These numbers are expected to increase going forward. Therefore, the increasing prevalence of small and medium-sized enterprises is driving the growth of the tax preparation services market.

What Are The Leading Segments Analyzed In The Tax Preparation Services Market?

The tax preparation services market covered in this report is segmented –

1) By Service: Tax Compilation Services, Tax Return Preparation Services, Other Services

2) By Deployment Mode: Cloud, On-Premises

3) By Application: Enterprise, Family, Personal, Other Applications

Subsegments:

1) By Tax Compilation Services: Compilation Of Financial Statements, Review And Preparation Of Tax Documents

2) By Tax Return Preparation Services: Individual Tax Return Preparation, Business Tax Return Preparation, E-Filing Services

3) By Other Services: Tax Planning And Advisory Services, Audit Support Services, Tax Resolution Services

What Long-Term Trends Will Shape The Future Growth Of The Tax Preparation Services Industry?

Technological advancement represents a significant trend gaining traction in the tax preparation services market. Leading companies within the tax preparation services industry are concentrating on developing innovative solutions to reinforce their market standing. For example, in January 2023, April Tax Solutions Inc., a Canada-based accounting and tax service company, introduced its Tax Platform technology. This platform streamlines the filing process and integrates tax preparation into wider financial wellness, particularly for Americans. It helps Americans manage their taxes by leveraging the latest advancements in natural language processing and human-assisted AI. April’s personalized engine provides taxpayers with a swift, seamless, and cost-effective tax experience, with the goal of simplifying the tax process. It establishes a new benchmark for tax solutions aimed at low-income families. April collaborates directly with banks and financial institutions to dismantle the traditional obstacles between tax and financial planning, thereby making tax work more straightforward.

Which Major Firms Are Strengthening Their Position In The Tax Preparation Services Industry?

Major companies operating in the tax preparation services market include BDO Global, Deloitte Consulting LLP, Ernst & Young Global Limited, H&R Block Inc., KPMG International Limited, RSM US LLP, Ryan LLC, Jackson Hewitt Tax Service Inc., PricewaterhouseCoopers International Limited, Crowe Global, Intuit Inc., 415 Group, Knight Dowl CPA, CapActix Business Solutions Pvt. Ltd., Entigrity Solutions LLC, Invensis Inc., Ramsey Solutions, Liberty Tax Service, FreeTaxUSA, Robert Hall & Associates, Commerce Clearing House, Drake Software, GoSystem Tax RS, Thomson Reuters corporation, TaxAct Holdings Inc., 1040.com, TaxSlayer LLC, E-file.com LLC, On-Line Taxes Inc., ezTaxReturn.com, PriorTax

Download The Full Report For Exclusive Market Findings:

https://www.thebusinessresearchcompany.com/report/tax-preparation-services-global-market-report

Which Region Shows The Highest Potential For Future Expansion In The Tax Preparation Services Market?

North America was the largest region in the tax preparation services market in 2024. North America is expected to be the fastest-growing region in the tax preparation services market report during the forecast period. The regions covered in the tax preparation services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Request A Customized Version Of The Tax Preparation Services Market Report:

https://www.thebusinessresearchcompany.com/customise?id=9597&type=smp

Browse Through More Reports Similar to the Global Tax Preparation Services Market 2025, By The Business Research Company

Accounting Software Global Market Report 2025

https://www.thebusinessresearchcompany.com/report/accounting-software-global-market-report

Accounting Services Global Market Report 2025

https://www.thebusinessresearchcompany.com/report/accounting-services-global-market-report

Financial Auditing Professional Services Global Market Report 2025

Get in touch with us:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 310-496-7795

Asia +44 7882 955267 & +91 8897263534

Europe +44 7882 955267

Email us at [email protected]

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model