What Key Growth Drivers Are Shaping The Performance Elastomers Market Forecast Toward $27.88 Billion?

Claim your 30% discount on Global Market Reports with code ONLINE30. Limited time only.

Claim 30% Off Global Market Reports With Code ONLINE30 – Insights on Tariff Effects, Global Trade, and Industry Disruptors

What Is The Current Size And Growth Outlook For The Performance Elastomers Market?

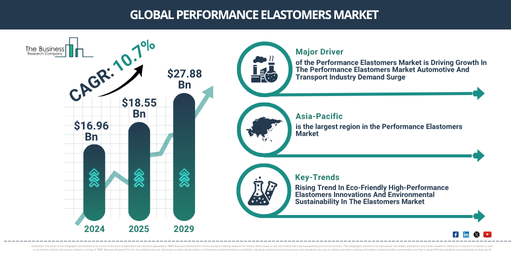

The market size of performance elastomers has seen significant growth in recent years, set to rise from $16.96 billion in 2024 to $18.55 billion in 2025, reflecting a compound annual growth rate (CAGR) of 9.4%. This historic period’s growth is attributed to several factors such as the demand from the automotive and transportation industry, construction, and infrastructure growth, advancements in material science, expansion in manufacturing and industry, and applications in the oil and gas industry.

The market size of performance elastomers is predicted to witness a swift expansion in the upcoming years, ballooning to a whopping $27.88 billion in 2029 with a compound annual growth rate (CAGR) of 10.7%. This projected rise during the forecast period is associated with eco-friendly and sustainable elastomers, a spike in demand for electric vehicles, the integration of elastomers in medical devices, 3D printing using elastomeric materials, and infrastructure advancement in emerging markets. The forecast period will also likely see major trends such as bio-based and recyclable elastomers, hyperplastic materials for various applications, intelligent elastomers for IoT devices, elastomers enhanced by nanomaterials, and elastomers in green building materials.

Get A Free Sample Of The Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7433&type=smp

Which Growth Drivers Are Shaping The Performance Elastomers Market Outlook?

The performance elastomers market is predicted to be driven by growing demands within the automotive and transportation sectors. With economies globally experiencing consistent growth, standards of living have risen, thus increasing purchasing power. This trend has been further fueled by the onset of the COVID-19 pandemic which has led individuals to seek safer means of transport that allow for social distancing, thereby enhancing the growth of the auto industry. Rising fuel prices have also contributed to the widespread adoption of electric vehicles, which offer higher efficiency and lower running costs. This growing demand for vehicles has caused a significant rise in the application of performance elastomers in automotive manufacturing due to their lightweight nature and design flexibility for both interior and exterior components. For instance, in May 2023, as per the European Automobile Manufacturers Association, a Belgium-based automobile association, global motor vehicle production reportedly touched 85.4 million units in 2022, this indicated a major rise of 5.7% compared to the previous year. Adding to this, in February 2022, Brand Finance plc, a brand evaluation firm based in the UK, reported that automobile sector recorded nearly 78 million unit sales in 2022, marking a substantial increase of 10%. Hence, escalating vehicle production has encouraged the enhanced utilization of performance elastomers, thereby propelling the performance elastomers market.

Which Segments Define The Structure Of The Performance Elastomers Market?

The performance elastomersmarket covered in this report is segmented –

1) By Type: Nitrile-Based Elastomers, Fluoroelastomer, Silicone Elastomers, Other Types

2) By End-Use Industry: Automotive And Transportation, Healthcare, Industrial Machinery, Building And Construction, Electrical And Electronics, Other End-Use Industry

Subsegments:

1) By Nitrile-Based Elastomers: Acrylonitrile Butadiene Rubber (NBR), Hydrogenated Nitrile Butadiene Rubber (HNBR)

2) By Fluoroelastomer: Fluorocarbon Elastomers (FKM), Perfluoroelastomers (FFKM)

3) By Silicone Elastomers: Room Temperature Vulcanizing (RTV) Silicone, High-Temperature Vulcanizing (HTV) Silicone, Liquid Silicone Rubber (LSR)

4) By Other Types: Thermoplastic Elastomers (TPE), Polyurethane Elastomers (PU), Styrene-Butadiene Rubber (SBR)

What Strategic Shifts And Innovations Are Influencing The Performance Elastomers Market?

The trend towards the creation of environmentally friendly, high-performing elastomers is gaining traction within the performance elastomer industry. This increase is attributable to heightened concern for the environment, leading to a demand for ecological elastomer products. Sustainable and bio-based elastomer items are crucial in realizing these objectives. Several businesses operating in performance elastomers are creating eco-friendly and safe elastomers to fortify their standing in the market. For instance, in May 2022, the US-based chemical and plastics manufacturer Dow introduced ENGAGE REN, a high-performance polyolefin elastomer derived from plants for sustainable footwear. This initiative means that ENGAGE REN polyolefin elastomers (POEs) are manufactured using renewable energy and plant-based feedstock such as used cooking oil. This approach permits the footwear industry to lessen its carbon footprint while also producing high-quality sustainable goods, such as lightweight foam with equivalent hardness, enhanced abrasion resistance, and consistent polymer.

Who Are The Global Leaders Steering The Performance Elastomers Market Forward?

Major companies operating in the performance elastomers market include Du Pont de Nemours, Arlanxeo, Zeon Chemicals LP, Solvay S.A, Dow Corning Corporation, Momentive Performance Materials Inc, Shin-Etsu Chemical Co, LANXESS AG, Huntsman Corporation, Covestro AG, ExxonMobil Chemical, BASF SE, LG Chem Ltd, Kuraray Co, Sumitomo Chemical Co, Mitsubishi Chemical Corporation, Tosoh Corporation, Asahi Kasei Corporation, JSR Corporation, Arkema S, Evonik Industries AG, Cabot Corporation, Trinseo LLC, KRAIBURG TPE GmbH & Co, Teknor Apex Company, RTP Company, PolyOne Corporation

Access The Complete Report Here:

https://www.thebusinessresearchcompany.com/report/performance-elastomers-global-market-report

What Regional Factors Are Accelerating Growth In The Performance Elastomers Market?

Asia-Pacific was the largest region in the performance elastomers market in 2024. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the performance elastomers market report include Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Customize Your Report Here:

https://www.thebusinessresearchcompany.com/customise?id=7433&type=smp

About The Business Research Company:

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead in the game.

Get in touch with us:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 310-496-7795

Asia +44 7882 955267 & +91 8897263534

Europe +44 7882 955267

Email us at [email protected]

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model