5 Major Insights On The Software As A Service (SaaS) Escrow Services Market 2024

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

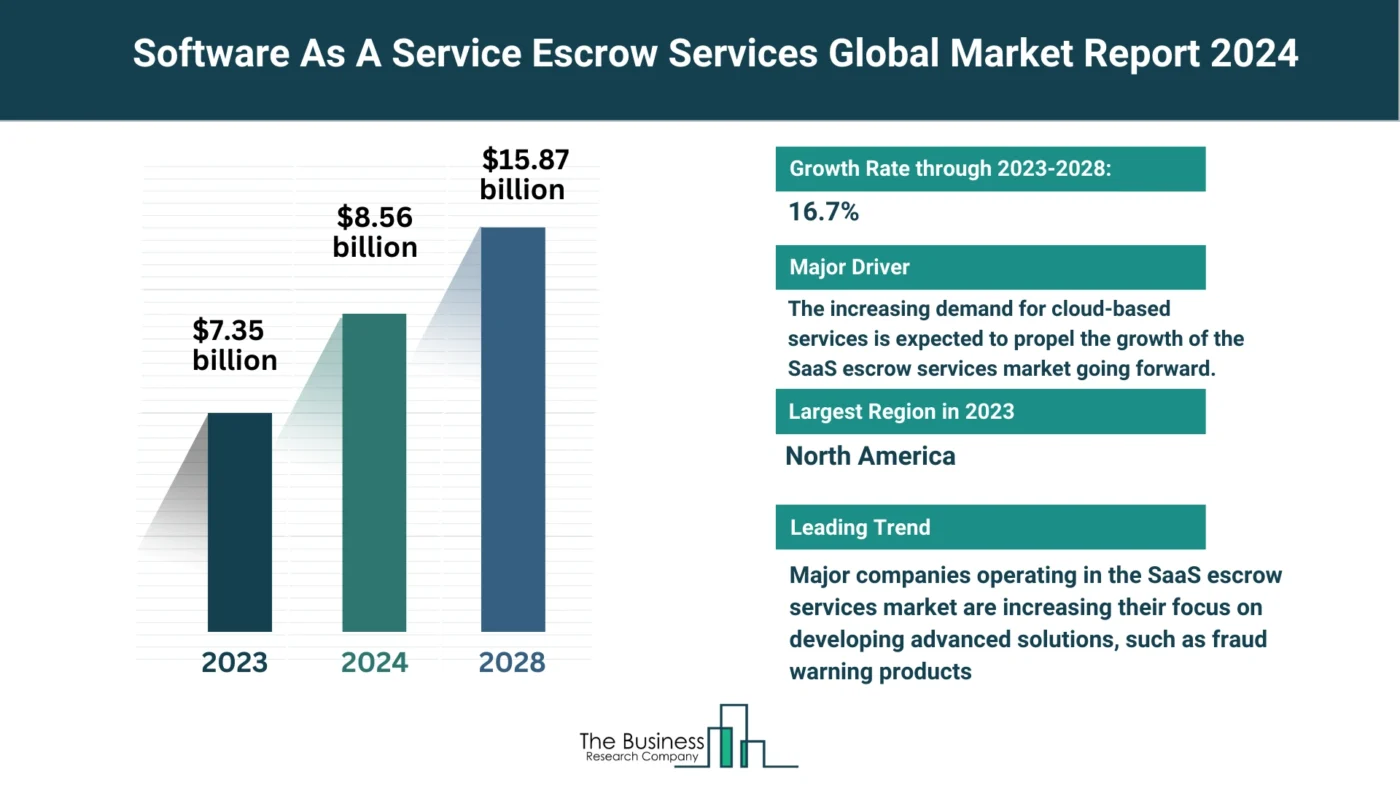

As per The Business Research Company’s Software As A Service (SaaS) Escrow Services Global Market Report 2024, the software as a service (SaaS) escrow services market is expected to show significant growth in the forecast period.

The SaaS escrow services market has experienced significant growth in recent years, and this trend is expected to continue. Let’s delve into the factors driving this expansion and the future outlook for the market.

Current Market Size and Growth Projections

- 2023-2024 Growth: The market is projected to grow from $7.35 billion in 2023 to $8.56 billion in 2024, achieving a compound annual growth rate (CAGR) of 16.5%.

- 2028 Forecast: By 2028, the market size is expected to reach $15.87 billion, with a CAGR of 16.7%.

Factors Driving Historic Growth

Increasing Adoption of Cloud-Based SaaS Solutions

- The rise of cloud-based services has led to a surge in demand for SaaS escrow services, ensuring continuity and reliability.

Growing Concerns about Data Security and Vendor Reliability

- Heightened awareness of data security risks and the need for reliable SaaS vendors has fueled demand for escrow services.

Rise of Complex SaaS Vendor Ecosystems

- Complex vendor ecosystems require robust risk management solutions to mitigate potential disruptions.

Evolving Customer Expectations for Business Continuity

- Businesses increasingly prioritize continuity and risk management, driving the adoption of escrow services.

View More On The Software As A Service (SaaS) Escrow Services Market Report 2024 – https://www.thebusinessresearchcompany.com/report/software-as-a-service-saas-escrow-services-global-market-report

Instances of SaaS Vendor Bankruptcies or Service Disruptions

- High-profile cases of vendor bankruptcies or service disruptions have underscored the importance of escrow agreements.

Future Growth Drivers

Heightened Focus on Cybersecurity and Data Protection Regulations

- Stricter regulations and increased focus on cybersecurity drive demand for secure escrow solutions.

Increased Scrutiny on Vendor Stability and Resilience

- Businesses prioritize vendors with proven stability and resilience, driving demand for escrow services.

Proliferation of Specialized SaaS Applications and Microservices

- The expansion of specialized applications necessitates tailored escrow agreements to safeguard interests.

Growing Complexity of SaaS Contract Agreements

- Complex contract agreements require sophisticated escrow solutions to manage risks effectively.

Continued Migration towards Cloud-Based SaaS Models

- Ongoing migration to cloud-based models increases the need for escrow services to ensure reliability.

Major Trends in the Forecast Period

Adoption of Blockchain Technology for SaaS Escrow Solutions

- Blockchain enhances security and transparency in escrow processes, gaining traction in the market.

Integration of Artificial Intelligence and Machine Learning

- AI and ML technologies optimize escrow processes, improving efficiency and risk management.

Emergence of Industry-Specific Standards for Escrow Agreements

- Industry-specific standards ensure compliance and consistency in escrow agreements.

Development of Automated Escrow Monitoring Tools

- Automated tools streamline monitoring and verification processes, enhancing convenience for stakeholders.

Growth of Subscription-Based Escrow Models

- Subscription-based models offer flexibility and scalability, catering to diverse business needs.

The Surge in Cloud-Based Services Adoption Fuels Market Growth

Impact of Cloud-Based Services Expansion

- Cloud services’ scalability and cost-effectiveness drive demand, boosting the SaaS escrow market.

- Example: In December 2023, the European Commission reported a 4.2 percentage point increase in EU enterprises adopting cloud computing services.

Benefits for Enterprises

- SaaS escrow services provide assurance and risk management techniques, fostering trust in cloud adoption.

- Example: Enterprises benefit from remote accessibility, scalability, and cost-effectiveness in modern business operations.

Key Players in the Market

Prominent companies in the SaaS escrow services market include:

- Fiserv Inc.

- Automatic Data Processing (ADP)

- Fidelity National Information Services (FIS)

- SS&C Technologies Holdings

- Iron Mountain Incorporated

- And many more.

Introducing Advanced Fraud Warning Solution

Development of Fraud Warning Products

- Companies focus on developing advanced solutions, such as fraud warning products, to protect against fraud.

- Example: Porch Group launched RynohVerif, featuring fraud protection, banking integration, and compliance support.

Benefits of Fraud Warning Solutions

- These solutions enhance security measures, operational efficiency, and trust in SaaS escrow agreements.

- Example: Real-time monitoring for fraud prevention streamlines operations and improves regulatory compliance.

Acquisition of Iron Mountain Intellectual Property Management (IPM)

Acquisition Details

- In June 2021, NCC Group acquired Iron Mountain IPM, expanding its service portfolio and market presence.

- Impact: The acquisition elevates NCC Group’s position in the SaaS escrow services market, benefiting clients and stakeholders.

Market Segmentation

The SaaS escrow services market is segmented by:

- Type: Hardware Configuration Services, Data Services, Legal Counseling Services, Other Types

- Enterprise Size: Large Enterprises, Small and Medium-Sized Enterprises

- Application: SaaS, PaaS, IaaS

- Industry Vertical: BFSI, Manufacturing, IT and Telecom, Retail, Energy and Utility, Healthcare, Media and Entertainment, Others

Regional Insights

- North America: The largest region in the SaaS escrow services market in 2023.

- Asia-Pacific: Expected to be the fastest-growing region in the forecast period.

Conclusion

The SaaS escrow services market is poised for significant growth, driven by factors such as cybersecurity concerns, vendor reliability, and cloud adoption. Stakeholders must stay informed about market trends and innovations to capitalize on emerging opportunities and ensure business continuity and security.

Request A Sample Of The Global Software As A Service (SaaS) Escrow Services Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=15001&type=smp

The Software As A Service (SaaS) Escrow Services Global Market Report 2024 provides an in-depth analysis on the software as a service (SaaS) escrow services market size, trends and drivers, opportunities, strategies, and companies analysis. The countries covered in the software as a service (SaaS) escrow services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

View More Related Reports –

Operating Systems & Productivity Software Publishing Global Market Report 2024

Software Products Global Market Report 2024

Business Analytics & Enterprise Software Global Market Report 2024

Learn More About The Business Research Company

The Business Research Company has published over 6500+ detailed industry reports, spanning over 3000+ market segments and 60 geographies. The reports draw on 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: